Social Media

Yalo raises $50M to build ‘c-commerce’ services for chat apps like WhatsApp

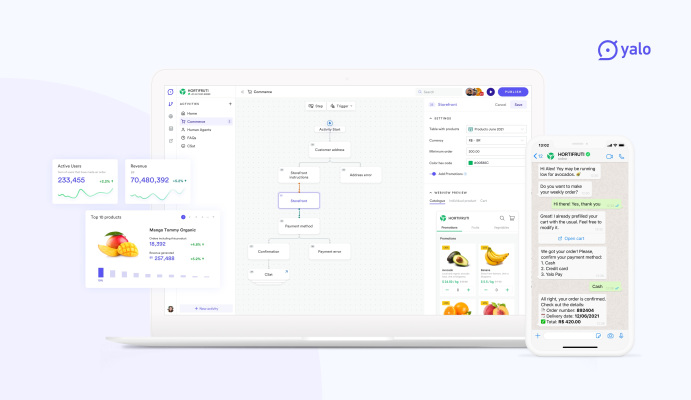

Facebook has long been working on raising WhatsApp’s profile as a channel for businesses to interact with (and sell to) their customers. Today, a startup that has built a suite of tools for retailers and others to build and run those services over WhatsApp and other messaging platforms is announcing growth funding to address that opportunity.

Yalo, which describes itself as a c-commerce (“chat commerce”) startup building tools for businesses to use messaging apps as part of their customer outreach and sales strategies, has raised $50 million, funding that it will be using to expand its services with a specific focus on emerging markets like Latin America and Southeast Asia.

Yalo already counts big brands like Unilever, Nestle, Coca-Cola and Walmart among the customers using its platform for sales and marketing efforts. In total that speaks to potentially an audience of 350 million, although Yaho doesn’t disclose how many people are actually using Yalo services as a part of that.

The funding is being led by B Capital, with participation from other, undisclosed, investors. Yalo, which recently rebranded from Yalochat, is on a funding roll at the moment: the company’s last round was in August, a $15 million Series B. B Capital’s investment is interesting, given Yalo’s focus on building tools for businesses to better utilize Facebook apps to interact with customers: the VC firm was co-founded by Eduardo Saverin, one of Facebook’s co-founders.

CEO Javier Mata said in an emailed interview that the reason for the swift funding was because of how fast business has been growing in the last year, part of the bigger boom for e-commerce overall.

“Covid fast forwarded us into the future and with it the need for conversational commerce increased significantly,” he said. “It went from being [one] digital commerce channel to becoming the main one.” He said that some of Yalo’s customers are seeing 80% of their sales happening on top of (and inside) messaging apps, a huge shift when you consider how reliant some brands in the consumer packaged goods sector have in the past been on more physical retail channels, whether that was a supermarket, a corner shop or a vending machine. “The market demand increased and we raised to continue overdelivering to customers.”

He added that Yalo wasn’t looking for more funding, “but then we saw an opportunity to accelerate our growth, so we did it. Everything we do is to provide value to our customers and in this case we decided to accelerate our product development so that customers would get conversational marketing, payments, and the world would get no-code builder to create all kind of conversational app sooner.”

Yalo is not disclosing its valuation with this round, CEO Javier Mata said in an email interview. The startup has raised $75 million to date, with other past investors including NXTP from Argentina and Sierra Ventures.

Founded in Mexico, now based in San Francisco, and currently active in Mexico, India, Brazil and the U.S., Yalo’s strategy is to play into the role messaging apps have taken on for consumers in many markets, but especially emerging markets, where many people “live” when on their phones, using them not just to chat to friends, but to interact with a wide range of services.

This is also something that messaging companies like Facebook, taking a page from companies like WeChat and Line in Asia, have been looking to cultivate. Over the years, WeChat and Line have leveraged their success as basic messaging apps to build out wider “super apps” covering all kinds of other forms of communication, as well as a plethora of services like payments, shopping, entertainment and news, both build by the apps themselves as well as by third parties, and now used by hundreds of millions of people.

WhatsApp is Yalo’s biggest platform “by a lot,” said Mata, with SMS in second place, so this is where a lot of its focus is right now.

While WhatsApp has been building out the facility to provide more services, Yalo has built a platform that sits in between brands and the apps themselves in order to use them. Its service — which works with other apps as well (it describes itself as platform-agnostic and able to be embedded in any messaging app) — lets agencies or the brands themselves plan and run marketing and sales campaigns, offer helpdesk services and take payments, giving customers the option to create “micro apps” to live in various messaging environments.

The emerging market focus for Yalo seems to mirror the role that messaging and mobile have taken in these markets overall. In many cases, consumers in developing economies skipped straight over using traditional computers and went online for the first time with cheap smartphones. As a result, that paved the way for consumers, whose digital consumption was more focused on mobile screens, to being more receptive and likely to use messaging apps for more than just messaging.

Mata believes that while emerging markets may have paved the way, though, more developed economies will follow.

“We went from brick and mortar to desktop apps, from apps to web apps, from web apps to mobile apps, and now the future/present is about conversational apps,” Mata said. “Conversational apps are the future because they take advantage of the messaging app that people have already downloaded and they do not need users to install or learn a new ux. It is easier to adopt a new technology when you do not need to replace a lot of legacy technology and you can just leapfrog. That is exactly what emerging markets are doing.”

He believes that “the US and other markets will get there but they will take longer, and eventually the lines between e-commerce and c-commerce will blur. You are starting to see that with text marketing, which is only a tiny fraction of conversational and it is already huge. It’s not a surprise that China is further ahead in digital than the US and conversational commerce is the predominant way of commerce through WeChat. Emerging markets leapfrog when it comes to adopting new tech.”

In the meantime, BCG estimates that c-commerce is already a $35 billion market, and will grow to $130 billion by 2025 in emerging markets alone, accounting for 60% of all digital commerce.

The question will be, then, that if this really takes off, whether the likes of Facebook will try to own the integration experience as much as owning the platform itself, or whether those who have helped to build more interesting commerce experiences on the traditional web — companies like Shopify and Magento, but also Amazon — might try to own this space too, presenting more competition down the line for Yalo.

Not an issue for now, investors say.

“Yalo has become the leading conversational commerce company, revolutionizing the way large enterprises engage with their customers and enabling them to transact through chat applications. We have been impressed with their execution and are very pleased to expand our relationship with them by leading their Series C round.” said Saverin in a statement.

-

Entertainment6 days ago

Entertainment6 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment5 days ago

Entertainment5 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment5 days ago

Entertainment5 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment5 days ago

Entertainment5 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment5 days ago

Entertainment5 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals