Social Media

Facebook shares shoot up after strong Q4 earnings despite data breach

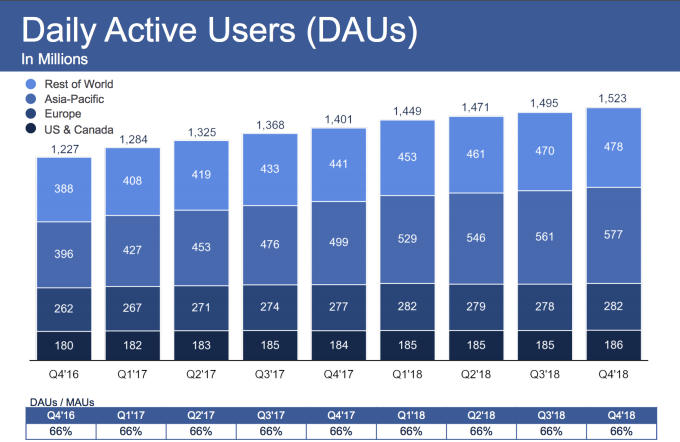

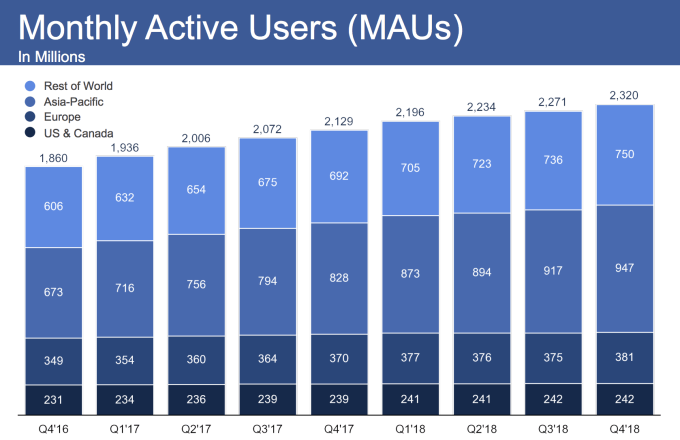

Facebook managed to beat Wall Street’s estimates in its Q4 earnings amidst a constant beat down in the press. Facebook hit 2.32 billion monthly users, up 2.2 perecent from 2.27 billion last quarter, speeding up its growth rate. Facebook climbed to 1.52 billion daily active users from 1.49 billion last quarter for a 2 percent growth rate that dwarfed last quarter’s 1.36 percent.

Facebook earned $16.91 billion off all those users with a $2.38 GAAP earnings per share. Those numbers handily beat Wall Street’s expectations of $16.39 billion in revenue and $2.18 GAAP earnings per share, plus 2.32 billion monthly and 1.51 billion daily active users. Facebook’s daily to monthly user ratio, or stickiness, held firm at 66 percent where it’s stayed for years, showing those still on Facebook aren’t using it much less.

Facebook shares had closed today at $150.42 but shot up over 11 percent following the record revenue and profit announcements to hover around $167. A big 30 percent year-over-year boost in average revenue per user in North America fueled those gains. Yet that’s still down from $186 where it was a year ago and a peak of $217 in July.

CEO Mark Zuckerberg went beyond his usual intro to the earnings report where he assures investors things are going well and highlights new opportunities. This quarter he noted “We’ve fundamentally changed how we run our company to focus on the biggest social issues, and we’re investing more to build new and inspiring ways for people to connect.”

Squeezing Money From The Olds

Facebook managed to grow its DAU in both the critical US & Canada and Europe markets where it earns the most money after stagnation or shrinkage in previous quarters. The fact that Facebook is no longer dwindling it its most lucrative markets is surely contributing to its share price climb. Facebook’s monthly active user plateaued in North America but roared up in Europe. That was shored up by a reversal of last quarter’s decline in Rest Of World average revenue per user, which fell 4.7% in Q3 but bounced back with 16.5 percent growth in Q4.

Facebook raked in $6.8 billion in profit this quarter as it slowed down hiring and only grew headcount 5 percent from 33,606 to 35,587. It seems Facebook has gotten to a comfortable place with its security staff-up in the wake of election interference, fake news, and content moderation troubles. Its revenue is up 30 percent year-over-year while profits grew 61 percent, which is pretty remarkable for a 15-year old technology company.

Earnings Call

Facebook’s plan to concentrate on product innovation in 2019 after focusing on security in 2018 was the core of today’s earnings call. Zuckerberg laid out a product roadmap for more ephemerality and encryption, how unifying the infrastructure of Facebook’s messaging apps will better connect Marketplace to WhatsApp, Groups will become an organizing function for more of the Facebook experience, and shopping features will crop up across the family of apps.

New stats included 500 million daily Instagram Stories users, 2 million advertisers on Stories, and that 2.7 billion people now use Facebook’s family of apps each month. However, CFO David Wehner warned the company would eventually stop sharing Facebook-only stats, presumably to mask the shift of younger users to its other apps. He also cautioned that due to the shift of users from feeds to Stories that Facebook has less experience monetizing, and targeting headwinds due to increased privacy scrutiny, Facebook predicts mid-single digit revenue growth rate reductions each quarter this year.

t morale isn’t quite as rosy. It’s been a brutal quarter for Facebook At least its swifter user growth rates show Facebook survived its biggest ever data breach without scaring off too many people. Meanwhile it’s continuously struggled with scandals like hiring opposition research firm Definers, and it saw its new teen app Lasso largely flop. Facebook will have to convince investors it knows how to win back the next generation, or at least keep squeezong a lot more money out of the last one like it did in Q4.

-

Entertainment7 days ago

Entertainment7 days ago‘Presence’s Steven Soderbergh and David Koepp on ghosts, horror, and hating winks

-

Entertainment6 days ago

Entertainment6 days ago‘Pee-wee as Himself’ review: Paul Reubens’ documentary is a must-see for ‘Playhouse’ fans

-

Entertainment6 days ago

Entertainment6 days agoTikTok ban: Influencers brace for an uncertain future

-

Entertainment5 days ago

Entertainment5 days agoFilms by Black creators to watch on Netflix

-

Entertainment4 days ago

Entertainment4 days ago‘Dimension 20’s ‘Gauntlet at the Garden’ was a euphoric experience for ‘Dungeons and Dragons’ fans everywhere

-

Entertainment7 days ago

Entertainment7 days agoHow to stop doomscrolling with apps you already have

-

Entertainment3 days ago

Entertainment3 days ago‘If I Had Legs, I’d Kick You’ review: Rose Byrne stuns in nauseating thrill ride about motherhood

-

Business3 days ago

Business3 days agoDeepSeek: Everything you need to know about the AI chatbot app