Business

What we all missed in UiPath’s latest IPO filing

Robotic process automation platform UiPath filed its first S-1/A this week, setting an initial price range for its shares. The numbers were impressive, if slightly disappointing because what UiPath indicated in terms of its potential IPO value was a lower valuation than it earned during its final private fundraising. It’s hard to say that a company looking to go public at a valuation north of $25 billion is a letdown, but compared to preceding levels of hype, the numbers were a bit of a shock.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Here at The Exchange, we wondered if the somewhat slack news regarding UiPath’s potential IPO valuation was a warning to late-stage investors; the number of unicorns being minted or repriced higher feels higher than ever, and late-stage money has never been more active in the venture-backed startup world than it has been recently.

If UiPath were about to eat about $10 billion in worth to go public, it wouldn’t be the best indicator of how some of those late-stage bets will perform.

But in good news for UiPath shareholders, most everyone — ourselves included! — who discussed the company’s price range didn’t dig into the fact that the company first disclosed quarterly results to the same S-1/A filing that included its IPO valuation interval. And those numbers are very interesting, so much so that The Exchange is now generally expecting UiPath to target a higher price interval before it debuts.

But in good news for UiPath shareholders, most everyone — ourselves included! — who discussed the company’s price range didn’t dig into the fact that the company first disclosed quarterly results to the same S-1/A filing that included its IPO valuation interval. And those numbers are very interesting, so much so that The Exchange is now generally expecting UiPath to target a higher price interval before it debuts.

That should either limit or close its private/public valuation gap, and, we imagine, lower a few investors’ blood pressure. Let’s look at the numbers.

UiPath’s fascinating 2020

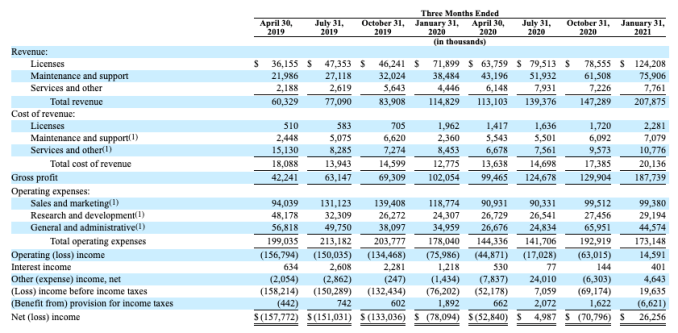

The top-line numbers for UiPath’s 2020 are impressive. As we’ve discussed, the company grew its revenues from $336.2 million in 2019 to $607.6 million in 2020, while boosting its gross profit margin by 7 percentage points to 89% last year. That’s great!

And it improved its net margins from -155% in 2019 to just -15% in 2020. The company’s rapid growth, improving revenue quality and extreme deficit reduction were among the reasons it was a bit surprising to see its estimated public-market value come in so far underneath its final private price.

But let’s dig into the company’s quarterly results — a big thanks to the reader who sent us in this direction — to get a clearer picture of UiPath. Here’s the data:

Image Credits: UiPath

-

Entertainment7 days ago

Entertainment7 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment6 days ago

Entertainment6 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment6 days ago

Entertainment6 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment6 days ago

Entertainment6 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment6 days ago

Entertainment6 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals