Business

TechCrunch+ roundup: 2022 VC predictions, how to hook an angel, product advisory councils

I’ve worked at early-stage startups where we relied on our best guesses to shape product pipelines and develop marketing strategies.

I have also held jobs at companies where we engaged directly with current and past customers to ask them what they wanted. You can probably guess which approach generated more favorable outcomes.

Whether it’s done informally via a Reddit AMA or a Twitter Space, it’s never a bad idea to interact with people who use your products and services.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

Well-researched personas are useful, but nothing is better than talking to a customer if you want to understand what delights them — and what they’re willing to pay for.

With a product advisory council (PAC), early-stage startups can tap into the their users’ hive mind. The benefits are many: PACs can help validate everything from marketing campaigns to future product planning.

But to build one, founders must first define clear goals and create value for participants. In this seven-step guide, you’ll find strategies and tactics for identifying key members and influencers, streamlining the communication process, and creating “a little FOMO.”

Thanks very much for reading TechCrunch+ this week. I hope you have a relaxing weekend!

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

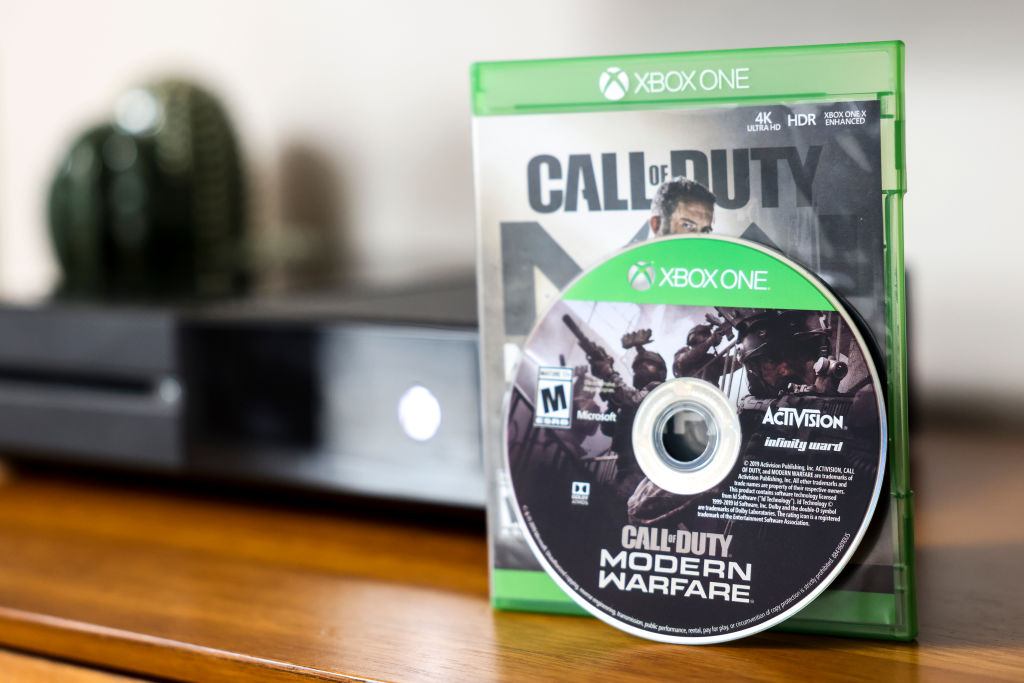

Why Microsoft’s $2T+ market cap makes its $68B Activision buy a cheap bet

Microsoft’s Xbox One video game console and Activision Blizzard’s Call of Duty: Modern Warfare video game arranged in Denver, Colorado, U.S., on Tuesday, Jan. 18, 2022. Microsoft Corp. agreed to buy Activision Blizzard Inc. in a $68.7 billion deal, uniting two of the biggest forces in video games to create the worlds third-biggest gaming company. Photographer: Michael Ciaglo/Bloomberg via Getty Images

Risk is an essential part of gambling, so it may be improper to describe Microsoft’s planned purchase of Activision Blizzard as a “bet.”

Considering that Microsoft has a market cap over $2 trillion, purchasing a gaming company that pumps out titles like Call of Duty, Guitar Hero and Candy Crush for $68 billion isn’t exactly fraught with danger.

According to Box CEO Aaron Levie, the move solidifies Redmond’s entry into AR/VR gaming.

“If you believe VR and immersive computing is the future — whether for consumer or business use cases — Activision helps Microsoft build a flywheel of content and technology that gets more users on board to this future.”

500 Global’s Christine Tsai shares her 2022 VC predictions

Image Credits: Bloomberg (opens in a new window) / Getty Images

2021 was a year like no other when it came to venture investment, and this year is poised to tread a similar path, writes 500 Global’s CEO and co-founder, Christine Tsai.

According to Tsai, 2022 will see web3 going mainstream, more capital flowing to underestimated founders, and broader investments in regions that have traditionally been overlooked.

“All signs point to a continued abundance of opportunities for startup founders and investors in the year ahead.”

Will quantum computing remain the domain of the specialist VC?

Image Credits: Olemedia (opens in a new window) / Getty Images

Quantum computing’s potential applications include machine learning and computer-aided drug design, but the industry is still very much in its early days.

In 2021, there were approximately 90 quantum investments that totaled $1.4 billion. A significant jump from $700 million the year before, but compared to SaaS, not even a drop in the bucket.

Even so, we’re already seeing quantum exits: IonQ reached a $2 billion valuation after its 2021 SPAC, and Rigetti plans to do the same this year as it develops its superconducting quantum computer.

In a comprehensive market map of the quantum computing industry, Maria Lepskaya, a senior associate at Runa Capital, sorted the top companies in the space into 12 quadrants, “each corresponding to particular quantum technology and a stage of startups.”

Dear Sophie: How do I successfully expand my company to the US?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m an entrepreneur in Guatemala and would like to come to the United States to expand my tech company.

What is the best way to do that?

— Groundbreaking Guatemalan

5 areas where VCs can play an outsized role in addressing climate change

Five green rocker switches, all switched in the power-on position except the last one, arranged in a horizontal row on blue colored background

Climate tech startups raised $32 billion in 2021, but that amount is nowhere close to the estimated $2.5-$4.8 trillion required to fund enough adaptation and mitigation projects to make a meaningful difference.

Private investors can’t fill the gap alone, but VCs are in a unique position to change this dynamic.

By backing climate startups, they can de-risk proven climate tech, build legitimacy to attract talent, help with scaling, attract new kinds of investors, and shape the overall ecosystem, write investor Jamil Wyne and climate finance researcher Abrar Chaudhury.

“While most VC verticals will be assessed in terms of how much they return to investors, climate tech may be unique in that its success will also be determined, essentially, by its contribution to the preservation of our livelihoods and how much it can avoid a winner-take-all dynamic.”

Inside Secfi’s 2021 state of stock options equity report

Image Credits: Andriy Onufriyenko (opens in a new window) / Getty Images

It’s great to have a stake in the company you’re helping to build, but when employees don’t know the optimal way to exercise their stock options, they usually end up with a raw deal.

Last year, startup employees paid an estimated $11 billion in avoidable taxes by exercising their options post-exit, rather than pre-exit, according to Secfi data.

In a post for TechCrunch+, CEO Frederik Mijnhardt shared his analysis of the biggest trends around stock options in 2021, including why, despite stellar IPOs, most employees couldn’t exercise their options until after the exit, dramatically increasing their tax liability.

“Looking ahead to 2022, it seems that the industry’s current trend toward mega-sized rounds of funding and longer exit timelines mean that for the average startup employee, their total cost to exercise stock options will continue to rise,” says Mijnhardt.

If you want startup funding, don’t make VCs feel ignorant

Image Credits: Andreas Mann/yeEm (opens in a new window) / Getty Images

It’s important to ask potential investors questions, but first-time founders often alienate VCs by quizzing them about the breadth and depth of their knowledge.

The trick, according to Prashant Fonseka, a partner at Tuesday Capital: only ask easy questions.

“Save the challenging questions for a time when you’re selecting from multiple investors who are ready to write checks after you’ve convinced them your company is fundable.”

The berserk pace of fintech investing outshines the global VC boom

Financial technology concept.

From Buy Now, Pay Later to open banking and social finance, fintech has scaled rapidly since the pandemic began. Investment has kept pace with growth: last year, fintech accounted for more than 20% of all venture investments.

In a deeply researched post, Mary Ann Azevedo and Alex Wilhelm examine how fintech overtook and outperformed every other sector to the point where its outlines mirror that of the broader venture market.

“To some degree, it appears that what is true for the venture capital market is also true for the fintech market, but in a more exaggerated form. Fintech is like most venture, but simply more extreme.”

Changes to corporate investing rules could diminish China’s resilient venture landscape

Image Credits: Nigel Sussman (opens in a new window)

China has a mature venture investment ecosystem, but recent interventions by the country’s government to rein in the tech sector have left many wondering whether startup investment in the country may suffer permanently.

In The Exchange, Alex Wilhelm makes the case that the country’s venture market will take a hit — but not a lethal one.

“There are lots of non-corporate investors in China who are still active. So long as they persist, the numbers will not collapse,” writes Alex.

“But potential new regulatory rules regarding major tech companies could prove to be a material knock to the country’s venture scene.”

5 essential factors for attracting angel investment

Image Credits: KTSDESIGN/SCIENCE PHOTO LIBRARY (opens in a new window) / Getty Images

In a guest post by Marjorie Radlo-Zandi, the veteran angel investor shared five key elements she considers before investing.

Her advice is clear and simple, which makes it particularly valuable in an environment where startup funding is flowing faster than ever.

Few investors expect a first-time founder’s pitch deck to be the most definitive analysis of a particular sector, but you’re better off being cautious instead of overly optimistic.

“An extraordinarily high projection signals you’re not altogether credible, and I advise you to avoid this mistake at all costs,” says Radlo-Zandi.

There’s never been a better time to found a startup, but you can’t catch pennies from VC heaven if there are holes in your story.

NFT volume, DAOs and the curious case of LooksRare

Image Credits: Nigel Sussman (opens in a new window)

NFT marketplace OpenSea largely had the field to itself, but after competitor LooksRare announced an airdrop for its $LOOKS token last week, it overtook OpenSea in trading volume.

“Let’s talk about incentives and governance tokens to parse out what’s up with LooksRare and the larger future of the financialization of everything,” wrote Alex Wilhelm in The Exchange.

LG and the hunt for the next-gen corporate incubator

On stage announcing LG Nova’s launch — Sokwoo Rhee, LG’s corporate SVP and head of LG Nova. Image Credits: LG

South Korean conglomerate LG produces everything from flat-screen TVs to soft drinks, so the idea that it would set up a startup incubator program isn’t a huge leap.

To learn more about the initiative, Haje Jan Kamps interviewed Sokwoo Rhee, LG’s corporate SVP and head of its North America Innovation Center.

“When I say new businesses, that can mean a lot of different things,” said Rhee. “We are willing to create a new business unit if the idea, suggestions and partnership hit a home run.”

Fintech and insurtech innovation in Brazil set to take off on regulatory tailwinds

Nubank’s present day headquarters in Sao Paulo, Brazil. Image Credits: NELSON ALMEIDA/AFP via Getty Images

A substantial portion of Brazil’s population remains underbanked, but instant payment system Pix processed more than 8 billion transactions last year.

Launched by Brazil’s central bank in November 2020, Pix is already used by 60% of the population.

To better understand how shifting regulations and increased adoption are impacting LatAm fintech startups, Anna Heim spoke to:

- Amy Cheetham, partner, Costanoa Ventures

- Javier Santiso, founder and general partner, Alma Mundi Ventures

- Rodrigo Teijeiro, CEO, RecargaPay

- Pedro Sônego de Oliveira, CEO TruePay

-

Entertainment7 days ago

Entertainment7 days agoHow to watch Pharrell’s ‘Piece by Piece’ at home: When is it streaming?

-

Entertainment7 days ago

Entertainment7 days ago‘Gladiator II’ review: Ridley Scott grapples with modern masculinity in ancient Rome

-

Entertainment6 days ago

Entertainment6 days agoBookTok’s growing rift over politics is heating up

-

Entertainment5 days ago

Entertainment5 days agoTrump taps Musk for ‘Department of Government Efficiency’: What it is and what’s at risk.

-

Entertainment5 days ago

Entertainment5 days agoTrump appoints Elon Musk to DOGE, a new U.S. government department

-

Entertainment4 days ago

Entertainment4 days agoGreatest birthday gifts for men: Practical and posh presents that are sure to please

-

Entertainment4 days ago

Entertainment4 days agoStocking up on holiday gift cards? Watch out for this scam.

-

Entertainment3 days ago

Entertainment3 days ago‘Interior Chinatown’ review: A very ambitious, very meta police procedural spoof