Startups

Portify raises £1.3M to help gig economy workers improve their financial wellbeing

Portify, a London fintech startup that offers an app and various financial products to help gig economy workers better manage their finances and in turn improve financial wellbeing, has raised £1.3 million in seed investment. The round is led by Kindred Capital, and company builder and investor Entrepreneur First (EF), with participation from various unnamed angel investors.

Founded in May last year by EF alumni Sho Sugihara (CEO) and Chris Butcher (CTO), Portify is setting out to address the financial volatility many flexible or so-called gig economy workers face. The startup offers a number of tailored financial products, accessible via its mobile app, to help flexible workers get insights into their current financial status and income, as well as do short and long-term financial planning.

The app — primarily a B2B2C play — is distributed in partnership with various gig economy platforms and also includes earning “rewards” at partnering merchants or service providers. The current Portify website lists TransferWise, Amazon, and Spotify as rewards.

“Portify’s vision is to enable financial security and wellbeing for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“Portify’s vision is to enable financial security and wellbeing for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“We work with companies to help build access to financial products that enable this security and progression, and offer this through a mobile app which workers can port between different jobs”.

Sugihara says there are three elements to Portify’s mission: helping flexible workers control “immediate income volatility”, helping them budget effectively on a day-to-day basis, and support with financial planning for the long-term.

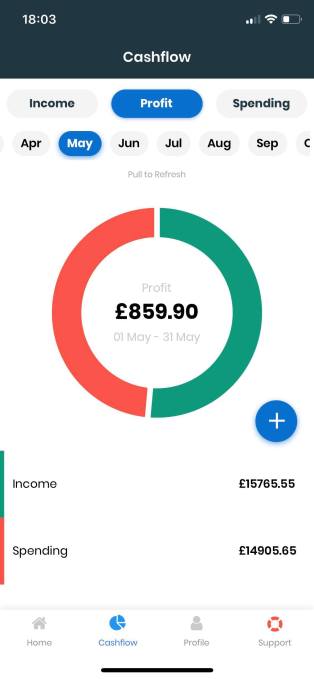

“Once a user gets access to our app, the first thing they do is securely connect their bank account,” he explains. “We then help control volatility by offering emergency credit with select stores to buy essentials products if required. We also help our users manage cash flow and budget for tax and other recurring expenses. By building up financial security and wellbeing from the ground up, our goal is to improve our user’s financial standing over the long term, whether through saving for retirement or helping them invest into their own businesses and careers”.

To that end, Sugihara says Portify is currently being used by independent workers in the gig economy and temp staffing sector. This covers couriers, ride-hailing drivers, retail shop floor staff, hospitality workers, amongst others. Its B2B customers span large gig economy platforms and digital temporary staffing agencies “with global coverage”.

-

Entertainment7 days ago

Entertainment7 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment6 days ago

Entertainment6 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment6 days ago

Entertainment6 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment6 days ago

Entertainment6 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment6 days ago

Entertainment6 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment6 days ago

Entertainment6 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment6 days ago

Entertainment6 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals

-

Entertainment3 days ago

Entertainment3 days ago‘The Brutalist’ AI backlash, explained