Business

How to be one of the ‘haves’ of SaaS

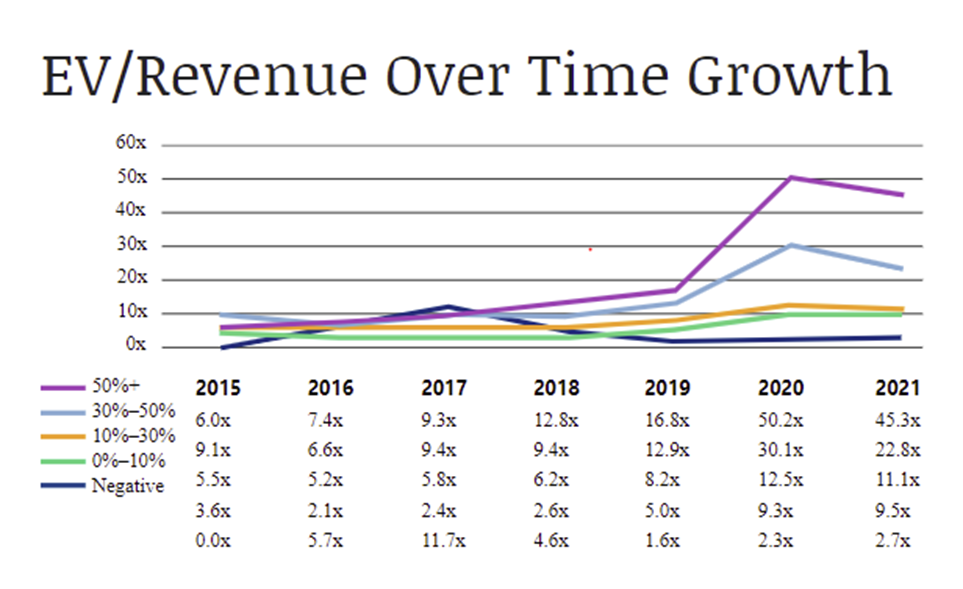

The flow of capital in SaaS is becoming increasingly bifurcated. There are the “haves” (public companies with revenue growth of over 30%) and the “have nots” (everyone else) of B2B software.

The chart below demonstrates just how drastically the “haves” separated themselves from the rest. With average EV/revenue multiple up +28.5x for companies that grew over 50% and +9.9x for companies that grew 30%-50% since 2019, compared to just +2.9x for those that grew by 10%-30%.

The real trick is identifying why certain companies are “haves” and how they remain that way. Put differently, what is it about companies like Zoom, Datadog, Monday.com and Asana that drive their outsized valuations? More importantly, are there strategies or tactics that management teams can employ to optimize for this type of outcome?

Growth in EV/revenue over time. Image Credits: OpenView Partners

Recent research shows that there are three key steps to becoming a “have”:

- Continued execution against large and growing market opportunities.

-

Entertainment7 days ago

Entertainment7 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment6 days ago

Entertainment6 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment6 days ago

Entertainment6 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment6 days ago

Entertainment6 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment6 days ago

Entertainment6 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals