Business

Holloway launches in-depth startup guides, aims to rewrite publishing with $4.6M from NYT, tech VCs

Founders need to get smart quickly about the many nuanced aspects of building a company, from understanding weird language in a big term sheet to hiring a key software developer.

But the best practical advice is scattered across blog posts, podcasts and books, and it gets outdated quickly as industry norms evolve. Even experienced founders spend a lot of time searching and still end up with the wrong information.

Holloway has an ambitious solution: Today, it’s launching a library of book-length online guides about work, written and regularly updated by teams of industry experts.

The flagship title is called Raising Venture Capital, which features 340 thoughtfully organized pages in 15 sections and three appendices on all aspects of the funding process. Designed for easy reading and easy searching in spite of the information density and length (it has a 14-hour total read-time), the guide could become a go-to resource for the startup world.

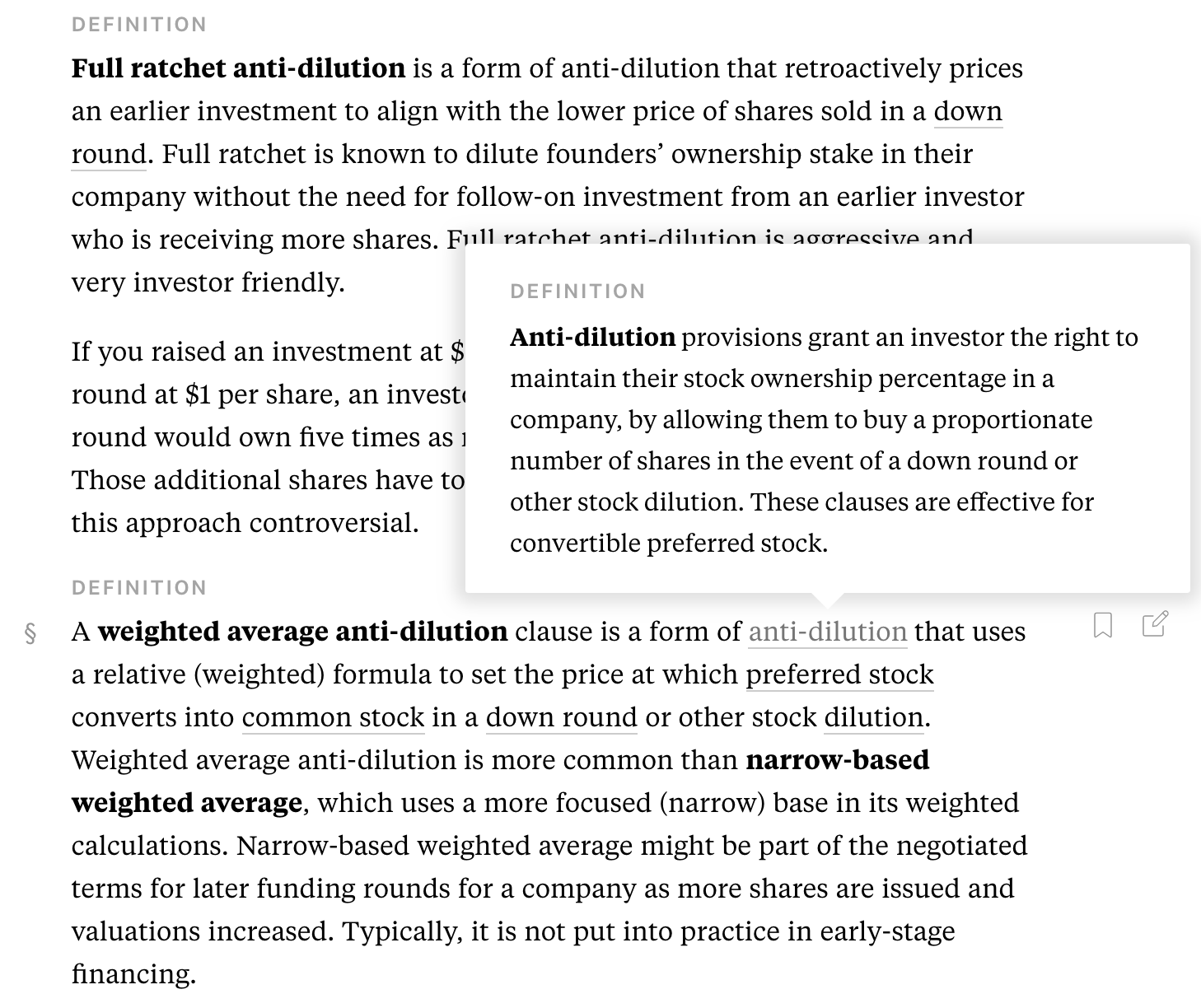

Some sections will be most appealing to newer founders, like the part on whether to raise VC in the first place. Other portions are relevant to even the most experienced serial entrepreneurs — like how to think through potential drag-along and pay-to-play provisions, full-ratchet anti-dilution clauses and other tricky terms one might find. Did you know that investors can include more than 20 types of conditions in a term sheet? Do you know how to handle each one?

With $4.6 million in seed funding from a combination of top tech investors and The New York Times that it is also announcing now, Holloway intends to expand to cover the wide variety of work-related topics about startups and technology, and beyond. The next guide, currently in progress, will be on technical hiring and recruiting. A relatively shorter sample guide on equity compensation is already available for free. The goal is to democratize access to how the best are doing business today (and take on traditional publishing).

The goal is to democratize access to how the best are doing business today (and take on traditional publishing).

“We didn’t just do this for Silicon Valley and New York,” and other startup-heavy cities, co-founder and chief executive Andy Sparks tells me, “we did this for people in cities like Columbus and Atlanta where startup communities are growing, but knowledge is harder to come by.”

The lawyers and other experts who author and edit the guides could otherwise cost more than $800 an hour, he explains, and won’t have time for many clients in the first place. (The company estimates there are $40,000 worth of legal fees in the VC guide.)

Sparks, previously the co-founder of analytics platform Mattermark, is also the lead author on “Raising Venture Capital” — along with another 20 or so contributors, like Brad Feld of the Foundry Group, and Darby Wong, co-founder of the popular legal document startup Clerky . The lead author of the technical recruiting guide is Ozzie Osman, former head of product engineering at Quora, and a main contributor to it is Aditya Agarwal, the former CTO of Dropbox.

The current pricing is $100 per guide forever (including future updates), with a discount available if you pre-order. Sparks says this may change to ensure the guides stay affordable, as well as cover the very real costs of producing this quality of content.

The big-picture bet is that the startup market is large enough to create strong demand for the initial guides, in the same way that many successful tech startups of this decade have started out serving companies like themselves. Some of the topics that Holloway is working on, like tech recruiting, naturally blend in with the rest of the business world and those wider audiences. Eventually, through expansion into broader work-related topics, Holloway’s online-first approach could compete against the existing book publishing industry at a bigger scale.

This is why the company is investing heavily in its software, in addition to its content. The interface was inspired by the experiences of co-founder Joshua Levy, a veteran technologist who found himself writing popular third-party guides on GitHub about how to use common services like AWS. Features in the software include search results that break out sections and sources, a detailed left-hand index view, a hyperlinked in-house glossary of hundreds of key terms, notes of warning and importance from experts and numerous links to third-party sources.

“We decided to invest in a digital reading experience that makes reading book-length content in a browser a great experience,” Sparks said, “which also means you will land on the right guide when you go hunting for answers on search engines like Google .”

Holloway co-founders Joshua Levy (left) and Andy Sparks (right)

You’ll even see a number of links to TechCrunch and Extra Crunch articles in the guides. Sparks tells me that the company plans to continue to link to a wide variety of sources in the future — so when guest columnists write something great and practical on Extra Crunch, we will help them to get this work featured in Holloway as well. The company is also accepting a variety of contributor types for its guides going forward, which you can find more details about here.

(On that note, we’ve published an excerpt from Holloway’s “Raising Venture Capital” guide, about pro rata terms and issues, on Extra Crunch. Subscribers can go check it out here, and find a special discount to Holloway inside.)

Sparks is careful to say that the current guides are not literally finished, despite all the effort put into them so far. And indeed, they will never be. Holloway is named after the “hollow ways” seen in the European countryside, where well-used roads have gradually sunk through hundreds of years of regular use. The company intends for its guides to be the paths that people who build companies tread year after year, where the knowledge that accumulates from the usage of many forms the clear direction that those in the future take.

The company’s investors include NEA, South Park Commons, The New York Times Co., Precursor Ventures and Comcast Ventures as well as Day One Ventures, Social Capital, Abstract Ventures, 415, Royal Bank of Canada, Lightspeed Ventures, & Full Tilt Capital. Angels include Leo Polovets, Lee Linden, Raj De Datta, Neil Parikh, Mikhail Larionov, Danielle & Kevin Morrill, Srinath Sridhar, Dennis Phelps and Kevin Lee.

-

Entertainment7 days ago

Entertainment7 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment6 days ago

Entertainment6 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment6 days ago

Entertainment6 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment6 days ago

Entertainment6 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment6 days ago

Entertainment6 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment6 days ago

Entertainment6 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment6 days ago

Entertainment6 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals