Business

Gradjoy is a Y Combinator-backed fintech to help you knock out your student loans

The right people to solve the trillion dollar student debt crisis might be the ones who are suffering from it the hardest.

If you’re a recent college graduate, there’s a 50 percent chance you took on debt when you moved off campus. If you’re like the average student borrower, you graduated with $29,800 of loan debt, and are making a monthly re-payment of between $200 and $300, according to a recent report from the New York Fed.

Gradjoy is a new Y Combinator-backed startup that wants to help the 45 million student debt borrowers in the U.S. manage their repayment plans. Within seven days of being a live platform and a marketing strategy that consisted of reaching out to a few universities, Gradjoy is already managing $20 million in loans.

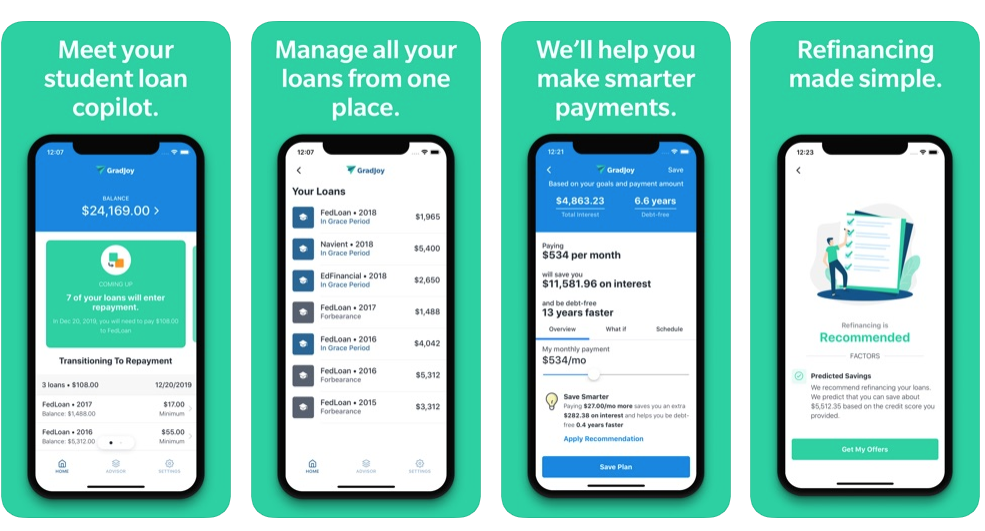

Co-founders Jose Bethancourt and Marco del Carmen turned down roles at Cloudflare and MongoDB, respectively, upon learning they’d been accepted to Y Combinator’s Summer 2019 class. Gradjoy bills itself as a “student loan co-pilot,” and currently exists a platform that helps users manage student loan repayments – whether that’s assessing pros and cons of refinancing, what a monthly payment should look like, and if they have any wiggle room based on greater income and spending habits. Gradjoy hopes to hammer a few cracks in the $1.5 trillion federal student loan debt crisis by giving new borrowers more insight into their repayment journey.

Loan companies will always advise borrowers to pay the minimum because they benefit from the outrageous interest fees amassed over time. Gradjoy wants to tap into your bank account and monitor your finances to deliver more transparent loan-management advice with a feature that lets you simulate how different payment amounts would affect your loans.

Bethancourt, a recent University of Texas graduate, was his own first user. He built the Gradjoy platform for himself while calculating his optimal student loan repayment plan in Excel. He’d met his co-founder in a coding bootcamp in the Rio Grande Valley at the border of Mexico and South Texas – where Bethancourt is originally from.

Jose Bethancourt (Left) Marco del Carmen (Right)

Student lending is a predatory industry that benefits off the ignorance of first-time borrowers and has been known to purposefully constrict resources for customers. New borrowers must navigate landmines like refinancing scams, the “7 minute rule” for customer service assistance and tricky requirements buried within the public service loan forgiveness program.

A question is posed for new startups that want to punch up against greedy student loan servicers like Navient and AES. Without replicating the corrupt business models that lenders have in order to make money off the student loan debt problem, how can newcomers like Gradjoy turn profitable?

Gradjoy bills itself as a “student loan co-pilot.”

Aside from venture capital, which Gradjoy will be seeking upon its graduation from Y Combinator, will make money in a few ways. In order to align with users’ goals, Gradjoy’s business model is tied to their savings. If a user refinances using GradJoy, they get a referral payment from their lending partners. The platform is currently beta testing their robo-advisor for debt, and in the future they plan on charging a small fee per month if they’re able to save a user money.

Student loans don’t only burden millennial bank accounts. The student loan debt crisis is creating an economic trend. Inability to repay student loans causes young people to rely on credit cards to make ends meet and delay major life choices like investing in property. Not to mention the affect of student debt on mental health for young people at an already-volatile point in their lives.

In five years, Gradjoy’s founders say they’d like to be running a more robust financial services product that was first focused on helping its customers pay off student loans. They hope to mobilize customers while they’re at the nascence of their financial independence, and scale up to launch a larger suite of financial service products.

-

Entertainment6 days ago

Entertainment6 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment6 days ago

Entertainment6 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment6 days ago

Entertainment6 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment6 days ago

Entertainment6 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment6 days ago

Entertainment6 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment6 days ago

Entertainment6 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals

-

Entertainment3 days ago

Entertainment3 days ago‘The Brutalist’ AI backlash, explained

-

Entertainment3 days ago

Entertainment3 days agoOnePlus 13 review: A great option if you’re sick of the usual flagships