Business

Garner Health raises $45M Series B for ‘totally objective’ doctor review service

When you shop for a holiday gift, you probably read at least one review. Garner Health’s bet is when you look for a doctor, you’ll want to do the same thing — but you’ll find that existing reviews aren’t enough to go on.

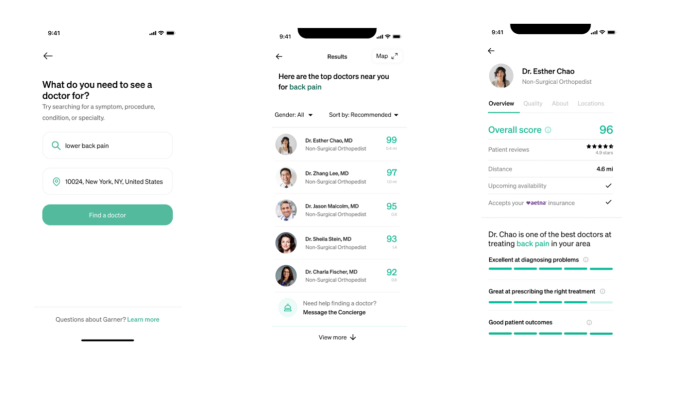

Garner Health, founded in 2019, is a service designed to help people sort through doctors. The company contracts with employers who offer health plans to workers. Employees can search through Garner’s app for doctors in their area, particularly ones who have expertise in their particular issue. And, if employees use the service to select a doctor, they’ll unlock funds provided by employers to cover medical costs.

The company closed a $45 million Series B round on Tuesday, led by Redpoint Ventures. It includes participation from Founders Fund, Thrive Capital and Optum Ventures.

This round follows a Series A round raised in February, and brings the company’s total financing to $70 million, CEO and founder Nick Reber told TechCrunch. This includes previous investment from Sequoia Capital and Maverick Ventures.

Reber said interest in this round has been driven by a tenfold increase in Garner’s client base, savings on healthcare costs for employers and a high rate of employee use of Garner’s service.

“We’re, on average, saving 10% realized savings for our employers. And we’re getting over 40% of employees to use our tool to find a doctor. So we’re really proud of both of those numbers,” he said.

On the surface, Garner’s doctor search functionality doesn’t sound all that different from a service like Zocdoc (though Zocdoc has raised some $150 million in growth financing this year, and has about a $2 billion valuation). Garner differentiates itself in two ways: the data it uses to rank, and analyze doctor performance, and the incentives it’s offering to employees and employers to use the service.

Garner Health’s doctor recommendations are compiled not from crowdsourced reviews, but rather, from medical claims data. Reber said that the company’s algorithms have combed through some 200 million patients’ worth of claims, and compared the procedures doctors are actually prescribing to those considered best practice in scientific literature.

“Working with the medical community, we’ve written over 500 different individual measures, of how doctors should treat different patients, and what are good health outcomes,” said Reber. “And we measure these individual behaviors in the claims data, and that gives us a lot more insight into how they practice who they’re keeping.”

The end result, per Reber, is a “totally objective” review system. Albeit, one that relies on the byzantine process of submitting medical claims. Medical claims have been used to conduct public health research, but there are some underlying problems with the approach: for example, medical claims may be incomplete, and certain conditions may not have billing codes, as one review points out.

It’s also easy to imagine that a system like this might privilege some doctors over others in unintended ways. If a doctor works with a community with high rates of underlying disease, or a community that’s already underserved medically, would that harm individual performance metrics, even if the doctor does the best they can?

Reber says his team is “obsessive about this.” His algorithms, he argues, will only compare doctors based on groups of comparable patients.

The second piece of Garner’s puzzle comes down to the way the company plans to work with employers. Part of the company’s promise is that if you select a doctor using the service, it will “unlock” funds provided by an employer to help cover out-of-pocket costs of the visit.

What’s the sell on that for employers? Reber’s pitch is that, already, companies are facing mounting healthcare costs and risk losing talent if they cut employee benefits.

Employers do see healthcare costs as a pain point. One survey of 300 large private employers conducted by the Kaiser Family Foundation found that 83% agreed that the cost of healthcare benefits was excessive (49% moderately agreed, 28% considerably agreed and 6% strongly agreed).

And, employers in general expect their healthcare costs to rise moderately next year — about 5%, per a survey conducted by benefits consultant Willis Towers Watson. This is, in part, driven by the fact that people will likely begin routine screenings and treatments that were once stalled during the pandemic’s first peaks.

Employers can go a few different routes to offset costs. Some are considering adding “spousal surcharges” to existing premiums, or may narrow the selection of in-network options, per the Willis Towers Watson survey. Other companies might pick up the slack themselves. Among the largest of the 1,502 employers surveyed by human resources consulting firm Mercer, 32% will actually decrease premium costs to employees in an attempt to retain talent.

Reber’s aim is to convince companies that Garner can help them stick with option 2: retain existing benefits, with the hope that directing patients toward certain specialists will cut long-term costs. So far, the company claims to have realized 10% savings for employers in terms of healthcare costs.

And, to sweeten the deal for employees, employers use some of those savings to cover some of the out-of-pocket bills.

“The basic idea is we’re going to cover that deductible bill, that copay, that coinsurance bill. And when you do, we know more savings are going back to your employer, which means that total costs borne by the employer are going down,” said Reber.

So far, says Reber, Garner has worked with about 100 clients in 47 states. But with this current round, Garner will look to expand its client base. Garner’s platform works with both large and small companies, but Reber sees special opportunities for companies in the small to mid-size range. Those companies, Garner says, have often been left out of advanced benefits solutions.

The company has other plans for the round beyond expanding a client base. The company is also in the process of rolling out a “scorecard” service specifically for doctors and providers. For example, it might reveal that one doctor is performing more of a certain test, or has a higher level of complications among patients than a regional average.

That service is intended to give doctors insight into how their patients do relative to other specialists, or, for instance, help primary care physicians make referrals.

So far, this provider and doctor-based service is a small arm of the business. So far, Reber says that they’re piloting this service with “a few” large primary care groups, hospital systems and other multi-speciality providers.

Finally, the funding will also go toward improving Garner’s data science and analysis capacity.

-

Entertainment6 days ago

Entertainment6 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment5 days ago

Entertainment5 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment5 days ago

Entertainment5 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment5 days ago

Entertainment5 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment5 days ago

Entertainment5 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals