Business

GajiGesa, a fintech focused on Indonesian workers, adds strategic investors and launches new app for micro-SMEs

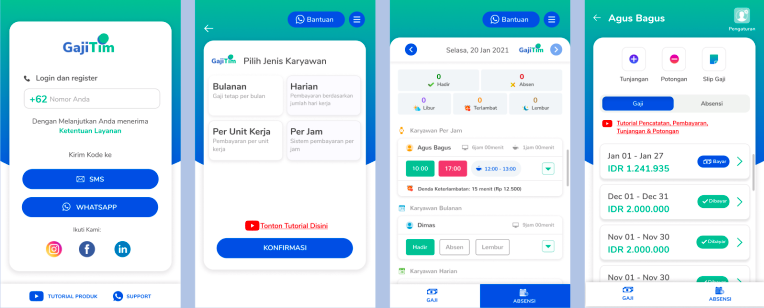

GajiGesa, a fintech startup that provides earned wage access (EWA) and other services for workers in Indonesia, has added strategic investors to help it launch new services and expand its user base. Its new backers include OCBC NISP Ventura, the venture capital arm of one of Indonesia’s largest banks, and the founders of grab-and-go coffee chain Kopi Kenangan. GajiGesa also recently expanded beyond the enterprise space with a new employee management system for SMEs and micro-SMEs. Called GajiTim, the app is aimed at businesses with between five to 100 workers and has gained more than 50,000 active users since it was launched in mid-March.

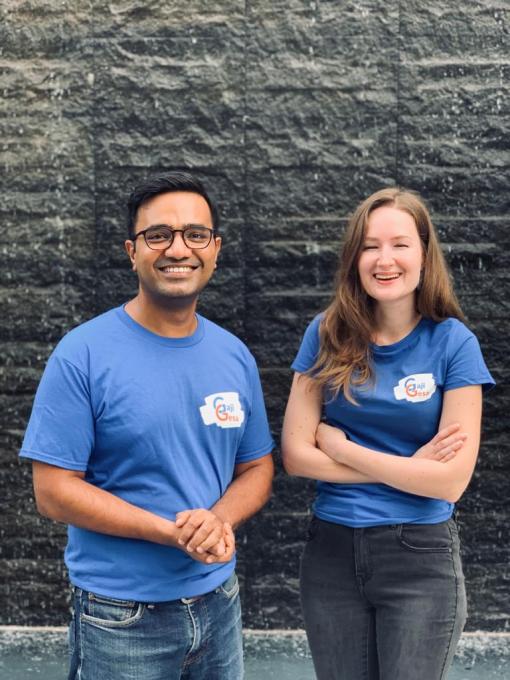

The amount of GajiGesa’s latest funding was undisclosed. The startup, launched last year by husband-and-wife team Vidit Agrawal and Martyna Malinowska, announced a $2.5 million seed round led by Defy.vc and Quest Ventures in February. Over the last quarter, GajiGesa’s enterprise customer base has doubled to more than 60 companies, representing tens of thousands of workers.

GajiGesa is part of a new wave of startups focused on digitizing the 60 million small businesses in Indonesia. Others include digital bookkeeping apps like BukuWarung and BukuKas for very small businesses, including neighborhood stores; Moka and Jurnal for larger companies; and CrediBook, which focuses on B2B businesses.

Before starting GajiGesa, Agrawal’s experience included serving as Uber’s first employee in Asia, while Malinowska was former product lead at Standard Chartered’s SC Ventures and alternative credit-scoring platform LenddoEFL. They created GajiGesa to give workers an alternative to payday and other high-interest lenders by allowing them to access their earned wages immediately, instead of waiting for semi-monthly or monthly paychecks. (Other companies that offer similar services around the world include Square, London-based Wagestream and Gusto). Based on a recent survey, GajiGesa said more than 75% of workers at companies that use its EWA feature have stopped using informal lenders for short-term needs.

The founders of Kopi Kenangan, the grab-and-go coffee chain backed by investors like Sequoia Capital India, Alpha JWC and Horizons Ventures, have become prolific angel investors in other startups, and their network will help GajiGesa onboard more employers, Agrawal told TechCrunch. Its strategic partnership with Bank OCBC NISP, meanwhile, will help it launch more services.

“One thing we are realizing is that a lot of employees who use the earned wage aspect of GajiGesa are expecting more kinds of products, either a loan product or an insurance product, and that’s where an opportunity arises to partner with a bank,” Agrawal told TechCrunch. About two-thirds of Indonesia’s population is “unbanked,” meaning they don’t have a bank account, so this also gives Bank OCBC NISP a chance to onboard new customers.

“Having a bank as a partner allows us to structure the right interest rate, the right size of products and create a larger impact,” said Malinowska.

GajiGesa does not charge interest rates or require collateral, as users are pre-approved by their employers. Instead, companies can decide to charge fees or offer GajiGesa as part of a benefits package. When a worker withdraws money, GajiGesa asks why they are using the Earned Wage Access feature, and presents that data to companies in an anonymized and aggregated format.

This allows employers to see what needs their work base has and potentially develop new benefits. For example, one of the top three reasons workers use EWA is to pay medical bills. “This is a strong signal to an employer that if you’re trying to retain employees, especially a blue-collar employee, even a basic insurance product might be very attractive for the family,” said Agrawal.

GajiGesa also discovered that many workers, especially in Tier 2 to Tier 3 cities, use its EWA to fund family businesses instead of taking out loans for working capital.

“A lot of families in Indonesia often have one member working in a factory with fixed salaries, and they have micro-industries at home, for example making wafers or stickers to sell in their communities or online,” said Agrawal. “They were going to loan sharks previously or private lenders for very expensive rates so they can run their business, and now the family member who is working in a factory can withdraw capital to support the family business so they don’t need to go to loan sharks.”

GajiTim was launched because the startup saw many inbound inquiries from SMEs, like restaurants, small factories and general stores, that have a lot of part-time workers. These businesses often rely on paper systems, including punch time cards, to track working hours and calculate paychecks. But this often results in disputes, so having an app that counts working hours and earned wages in real time gives workers more transparency and helps companies save time. GajiTim also has access to GajiGesa’s flagship EWA service and allows it to bring more clients onto the platform.

-

Entertainment6 days ago

Entertainment6 days agoWordPress.org’s login page demands you pledge loyalty to pineapple pizza

-

Entertainment7 days ago

Entertainment7 days agoRules for blocking or going no contact after a breakup

-

Entertainment6 days ago

Entertainment6 days ago‘Mufasa: The Lion King’ review: Can Barry Jenkins break the Disney machine?

-

Entertainment5 days ago

Entertainment5 days agoOpenAI’s plan to make ChatGPT the ‘everything app’ has never been more clear

-

Entertainment4 days ago

Entertainment4 days ago‘The Last Showgirl’ review: Pamela Anderson leads a shattering ensemble as an aging burlesque entertainer

-

Entertainment5 days ago

Entertainment5 days agoHow to watch NFL Christmas Gameday and Beyoncé halftime

-

Entertainment4 days ago

Entertainment4 days agoPolyamorous influencer breakups: What happens when hypervisible relationships end

-

Entertainment3 days ago

Entertainment3 days ago‘The Room Next Door’ review: Tilda Swinton and Julianne Moore are magnificent