Business

Essential steps to thriving and surviving while fundraising

The road to a successful funding round can be a long and arduous one.

From your first meeting with a VC to money in the bank, a seed round takes on average 18.5 weeks. Within that time frame, you are pitching your heart out to multiple investors and ideally setting a number of meetings, either virtual or in-person.

You’re also busy building and constantly tweaking your narrative (and pitch deck) and managing each of those meetings and the necessary followup. Then, if things go well, you’re negotiating term sheets and final closing details. All the while running a startup with equal intensity.

Having transparency into how investors engage with your pitch deck gives you an advantage.

So how do you prepare for this important stage in your company’s growth, navigate the challenges of a fundraise, and not let the process overwhelm the responsibility of still running your business? While not every fundraise is the same, founders can tap the experience of others who have been down this path to ensure their fundraising efforts are efficient and, most importantly, successful.

This can be done both qualitatively and quantitatively. Tap your network to learn from both peers that have been through the fundraising process recently as well as more seasoned experts that can impart useful wisdom and perspective. And quantitatively, there’s a ton of data out there on the fundraising process that can remove the mystery and uncertainty for you as a founder. Having very clear data on where VCs focus their time on pitch decks or in meetings will guide you to deliver a finely tuned pitch to the right investor.

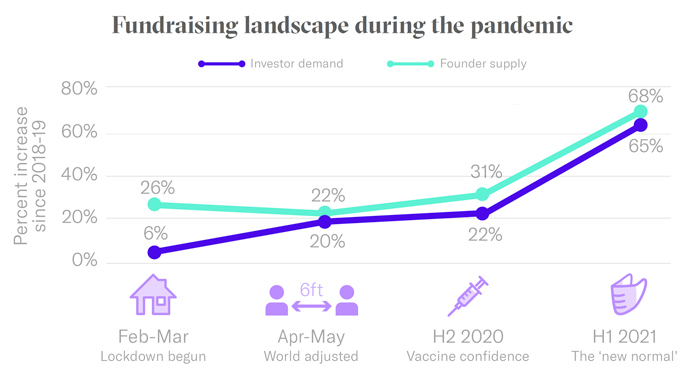

This year has shown growth in the fundraising landscape like we’ve never seen before. Records in deal dollars have been continuously broken, and VC demand and startup supply have increased consistently since April 2020. While the tides have seemingly turned in the favor of founders, there are different investor expectations for each stage of funding, from pre-seed to Series A and beyond.

Image Credits: DocSend’s weekly PDI metrics

As more founders pitch their startups, funding rounds are competitive, so you need to prepare accordingly. Below I’ll lay out a few essential steps every founder will take during their fundraising journey, with proven and data-driven strategies to approach them.

The right pitch deck

A good pitch deck is key to opening the door to funds. It’s the first impression you make on a VC, and with them breezing through decks at record speeds (2 minutes and 34 seconds per deck), yours has to count. It needs to clearly communicate purpose and value, demonstrating that your company is a solid investment and that your idea is worth their money and time.

By analyzing deck compilation and comparing it to metrics, DocSend has found that startups that have successfully fundraised have commonalities across their pitch decks. This can be broken down by different stages and help you understand the order of your slides, which sections to include more detail on, which sections will get the most attention and more.

-

Entertainment6 days ago

Entertainment6 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment5 days ago

Entertainment5 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment5 days ago

Entertainment5 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment5 days ago

Entertainment5 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment5 days ago

Entertainment5 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals