Business

Credit startup Migo expands to Brazil on $20M raise and Africa growth

After growing its lending business in West Africa, emerging markets credit startup Migo is expanding to Brazil on a $20 million Series B funding round led by Valor Capital Group.

The San Franicso-based company — previously branded Mines.io — provides AI-driven products to large firms so those companies can extend credit to underbanked consumers in viable ways.

That generally means making lending services to low-income populations in emerging markets profitable for big corporates, where they previously were not.

Founded in 2013, Migo launched in Nigeria, where the startup now counts fintech unicorn Interswitch and Africa’s largest telecom, MTN, among its clients.

Offering its branded products through partner channels, Migo has originated more than 3 million loans to over 1 million customers in Nigeria since 2017, according to company stats.

“The global social inequality challenge is driven by a lack of access to credit. If you look at the middle class in developed countries, it is largely built on access to credit,” Migo founder and CEO Ekechi Nwokah told TechCrunch.

“What we are trying to do is to make prosperity available to all by reinventing the way people access and use credit,” he explained.

Migo does this through its cloud-based, data-driven platform to help banks, companies and telcos make credit decisions around populations they previously may have bypassed.

These entities integrate Migo’s API into their apps to offer these overlooked market segments digital accounts and lines of credit, Nwokah explained.

“Many people are trying to do this with small micro-loans. That’s the first place you understand risk, but we’re developing into point of sale solutions,” he said.

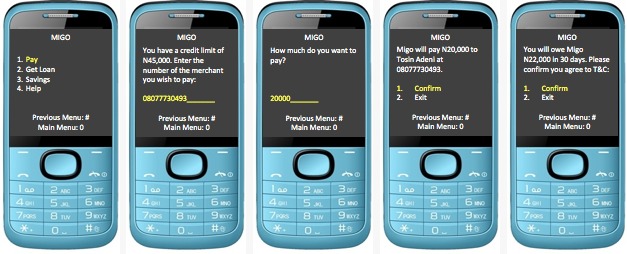

Migo’s client consumers can access their credit lines and make payments by entering a merchant phone number on their phone (via USSD) and then clicking on “Pay with Migo.” Migo can also be set up for use with QR codes, according to Nwokah.

He believes structural factors in frontier and emerging markets make it difficult for large institutions to serve people without traditional credit profiles.

“What makes it hard for the banks is its just too expensive,” he said of establishing the infrastructure, technology and staff to serve these market segments.

Nwokah sees similarities in unbanked and underbanked populations across the world, including Brazil and African countries such as Nigeria.

“Statistically, the number of people without credit in Nigeria is about 90 million people and its about 100 million adults that don’t have access to credit in Brazil. The countries are roughly the same size and the problem is roughly the same,” he said.

On clients in Brazil, Migo has a number of deals in the pipeline — according to Nwokah — and has signed a deal with a big-name partner in the South American country of 210 million, but could not yet disclose which one.

Migo generates revenue through interest and fees on its products. With lead investor Valor Capital Group, Velocity Capital and The Rise Fund joined the startup’s $20 million Series B.

Increasingly, Africa — with its large share of the world’s unbanked — and Nigeria — home to the continent’s largest economy and population — have become proving grounds for startups looking to create scalable emerging market finance solutions.

Migo could become a pioneer of sorts by shaping a fintech credit product in Africa with application in frontier, emerging and developed markets.

“We could actually take this to the U.S. We’ve had discussions with several partners about bringing the technology to the U.S. and Europe,” said founder Ekechi Nwokah. In the near-term, though, Migo is more likely to expand to Asia, he said.

-

Entertainment7 days ago

Entertainment7 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment7 days ago

Entertainment7 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment4 days ago

Entertainment4 days ago‘The Brutalist’ AI backlash, explained

-

Entertainment4 days ago

Entertainment4 days agoOnePlus 13 review: A great option if you’re sick of the usual flagships

-

Entertainment3 days ago

Entertainment3 days agoWhat drives John Cena? The ‘What Drives You’ host speaks out

-

Entertainment2 days ago

Entertainment2 days ago10 Sundance films you should know about now

-

Entertainment2 days ago

Entertainment2 days agoEvery Samsung Galaxy Unpacked announcement, including S25 phones

-

Entertainment1 day ago

Entertainment1 day agoA meteorite fell at their doorstep. The doorbell camera caught it all.