Startups

Credit Karma acquires mortgage platform Approved

Credit Karma, the service best known for providing free credit score monitoring and other financial advice (mostly to millennials), is getting into the mortgage business. The company today announced that it has acquired Approved, a mortgage platform that brings modern technology to a process that even today often still involves faxing documents back and forth. The companies did not disclose the financial details of the transaction.

At first glance, this may seem like a bit of an odd acquisition, given that Approved is mostly a service for banks and mortgage brokers. But it also makes perfect sense for Credit Karma to get into the mortgage business.

Indeed, Credit Karama Chief Product Officer Nikhyl Singhal told me that he sees this as the natural next step in the company’s evolution.

Indeed, Credit Karama Chief Product Officer Nikhyl Singhal told me that he sees this as the natural next step in the company’s evolution.

“As we’ve expanded, you’ve seen us move from credit cards as a way to help members with that part of their life to first personal loans to auto — meaning auto loans, auto insurance,” he said. “Today, we’re really talking more publicly about mortgage. Mortgage being for many of our members the most important financial decision they’ll make.”

It’s also no secret that Credit Karma’s largest user base is millennials. As they get older and start getting to the point where they consider buying a home (assuming they are in the financial position to do so), the company obviously wants to keep those users engaged on their platform and offer them more services.

Singhal also stressed that 80 percent of Credit Karma members are active on the service before they get a new mortgage — and Credit Karma obviously knows all of this because it is able to collect a lot of very detailed financial data about its users.

As Singhal noted, Credit Karma has been working on getting deeper into the mortgage business for about 18 months. “The acquisition is just the continuing effort of saying, ‘look, we’re serious about taking our scale and being that trusted destination for our members as it relates to helping them with their mortgage.’”

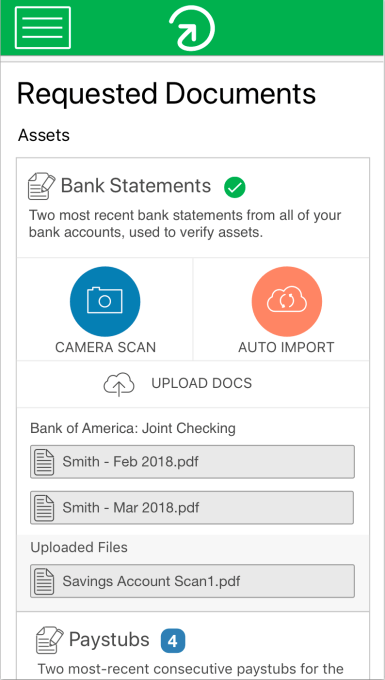

Credit Karma already offers some mortgage brokerage services and today’s acquisition is meant to help speed up this process with the help of Approved’s technology. “What approved has spent a lot of time doing is working with lenders to help them automate and make them more efficient,” Singhal explained. A more efficient process, Singhal expects, means the lenders can reduce rates and save Credit Karma members money.

Approved CEO Andy Taylor and CTO Navtaj Sadhal are both Redfin alums, so they know this business well. Taylor told me that he believes that Credit Karama will allow him to scale his service up beyond what a stand-alone company could’ve done. Taylor tells me that he sees Approved’s mission as helping consumers navigate the often tedious and painful world of getting a mortgage. “Moving to Credit Karma is going to immediately give us the sort of resources and immediate scale to continue to drive that mission-driven work,” he said. “We can reach significantly more people than we could otherwise. We can spend less time focusing in on the minutia of building the lender system and more time focussing on bringing transparency to the transaction and having a better loan application process.”

-

Entertainment6 days ago

Entertainment6 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment5 days ago

Entertainment5 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment5 days ago

Entertainment5 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment5 days ago

Entertainment5 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment5 days ago

Entertainment5 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals