Startups

Africa Roundup: Kenya’s BRCK acquires EveryLayer, Nigeria’s TeamApt eyes global expansion

Kenyan communications hardware company BRCK acquired the assets of Nairobi-based internet provider Surf and its U.S. parent EveryLayer in a purchase deal of an undisclosed amount in February.

Based in Nairobi, Surf is a hotspot service provider aimed at offering affordable internet to lower-income segments. BRCK is a five-year-old venture that pairs its rugged Wi-Fi routers to internet service packages designed to bring people online in frontier and emerging markets.

With the acquisition, BRCK gains the assets of San Francisco-based EveryLayer and its Surf subsidiary, including 1,200 hotspots and 200,000 active customers across 22 cities in Kenya, according to BRCK CEO and founder Erik Hersman.

Backed by $10 million from investors, including Steve Case’s Revolution VC fund, BRCK plans to use its new resources to expand to an undisclosed East African country and is eyeing options abroad. “We’re looking at Indonesia and starting our pilot in Mexico next month,” Hersman told TechCrunch on a call from Kigali.

BRCK built its platform around providing internet solutions primarily in Kenya and Rwanda. In 2017, the company rolled out its SupaBRCK product and paired it to its Moja service, which offers free public Wi-Fi — internet, music and entertainment — subsidized by commercial partners.

There’s not a requirement to click on or watch advertisements to gain Moja access, though users can gain faster speeds if they “interact with one of our business partners…by doing a survey, downloading an app or watching an ad,” said Hersman.

In 2018, BRCK began offering SupaBRCK devices to drivers of Nairobi’s Matatu buses for Kenyan commuters to access Moja. As of January, Moja traffic is racking up 300,000 active uniques and 3.7 million impressions per month, according to Hersman. There’s more on the deal and Africa’s internet connectivity equation in this TechCrunch exclusive on the acquisition.

Nigerian fintech startup TeamApt raised $5.5 million in capital in a Series A round led by Quantum Capital Partners.

Nigerian fintech startup TeamApt raised $5.5 million in capital in a Series A round led by Quantum Capital Partners.

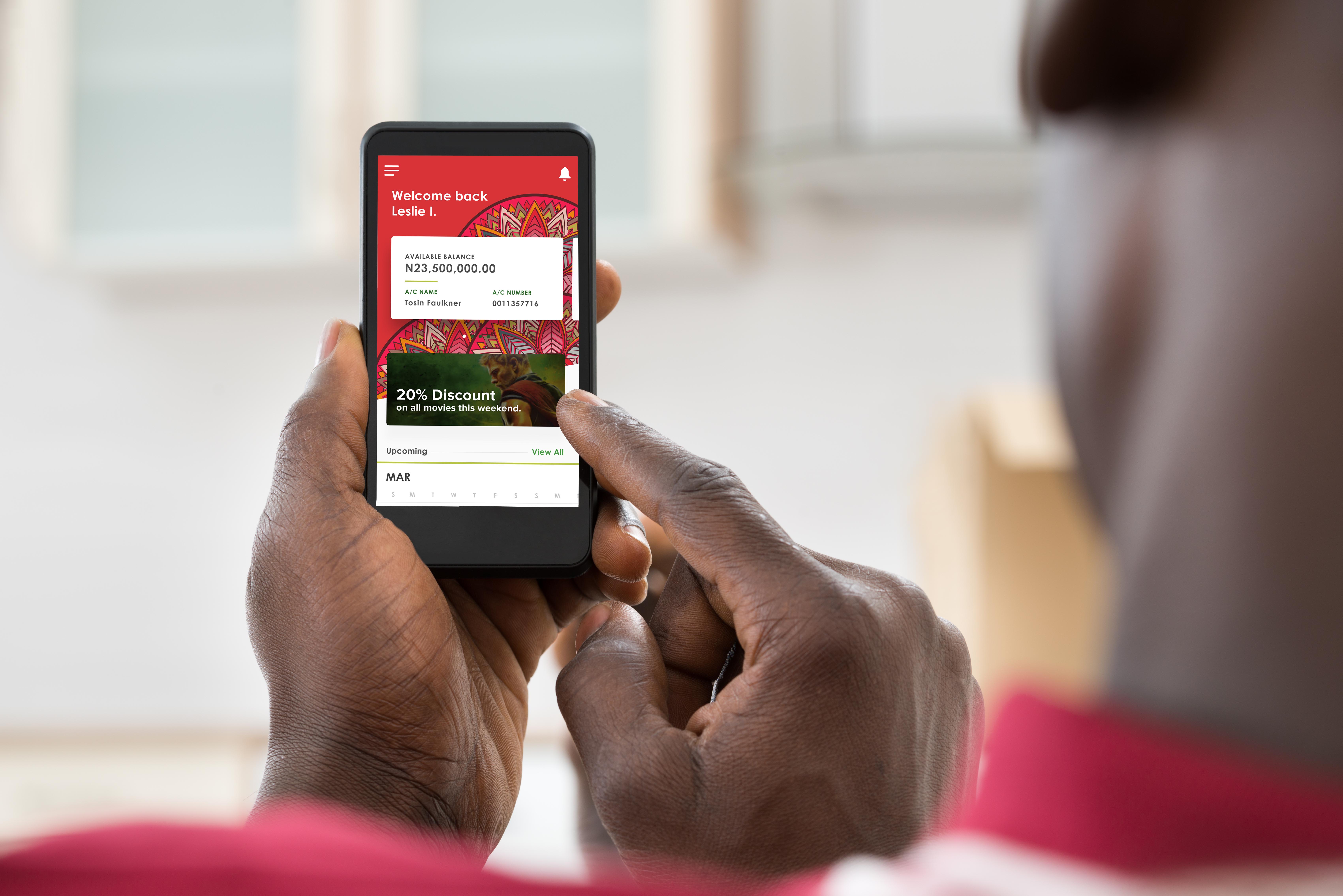

The Lagos-based firm will use the funds to expand its white label digital finance products and pivot to consumer finance with the launch of its AptPay banking app.

Founded by Tosin Eniolorunda, TeamApt supplies financial and payment solutions to Nigeria’s largest commercial banks — including Zenith, UBA and ALAT.

For Eniolorunda, launching the fintech startup means competing with his former employer, the later-stage Nigerian tech company Interswitch.

The TeamApt founder is open about his company going head to head not only with Interswitch, but other Nigerian payment gateway startups, including Paystack and Flutterwave, he told TechCrunch in this exclusive.

TeamApt, whose name is derivative of aptitude, bootstrapped its way to its Series A by generating revenue project to project working for Nigerian companies, according to its CEO.

The venture now has a developer team of 40 in Lagos, according to Eniolorunda, who spent six years at Interswitch as a developer and engineer himself, before founding the startup in 2015.

“The 40 are out of a total staff of about 72 so the firm is a major engineering company. We build all the IP and of course use open source tools,” he said.

TeamApt’s commercial bank product offerings include Moneytor — a digital banking service for financial institutions to track transactions with web and mobile interfaces — and Monnify, an enterprise software suite for small business management.

On performance, TeamApt claims 26 African bank clients and processes $160 million in monthly transactions, according to company data. Though it does not produce public financial results, TeamApt claimed revenue growth of 4,500 percent over a three-year period.

Quantum Capital Partners, a Lagos-based investment firm founded by Nigerian banker Jim Ovia, confirmed it verified TeamApt’s numbers.

“Our CFO sat with them for about two weeks,” Elaine Delaney told TechCrunch.

TeamApt’s results and the startup’s global value proposition factored into the fund’s decision to serve as sole-investor in the $5.5 million round.

Delaney will take a board seat with TeamApt “as a supportive investor,” she said.

TeamApt plans to develop more business and consumer-based offerings. “We’re beginning to pilot into much more merchant and consumer-facing products where we’re building payment infrastructure to connect these banks to merchants and businesses,” CEO Tosin Eniolorunda said.

Part of this includes the launch of AptPay, which Eniolorunda describes as “a push payment, payment infrastructure” to “centralize…all services currently used on banking mobile apps.”

The company recently received its license from the Nigerian Central Bank to operate as a payment switch in the country.

On new markets, TeamApt is looking to Canada and Europe with a specific expansion announcement expected by fourth quarter 2019, according to Eniolorunda.

TeamApt’s CEO is open about the company’s future intent to list. “The project code name for the recent funding was NASDAQ. We’re clear about becoming a public company,” said Eniolorunda.

More Africa Related Stories @TechCrunch

African Tech Around The Net

-

Entertainment7 days ago

Entertainment7 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment6 days ago

Entertainment6 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment6 days ago

Entertainment6 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment7 days ago

Entertainment7 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment7 days ago

Entertainment7 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment7 days ago

Entertainment7 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals

-

Entertainment3 days ago

Entertainment3 days ago‘The Brutalist’ AI backlash, explained

-

Entertainment4 days ago

Entertainment4 days agoOnePlus 13 review: A great option if you’re sick of the usual flagships