Business

Obrizum uses AI to build employee training modules out of existing content

The market for corporate training, which Allied Market Research estimates is worth over $400 billion, has grown substantially in recent years as businesses realize the cost savings in upskilling their workers. One PwC report found that teaching employees additional skills can save a company between 43% and 66% of layoff costs alone, depending on the salary.

But it remains challenging for organizations of a certain size to quickly build and analyze the impact of learning programs. In a 2019 survey, Harvard Business Review found that 75% of managers were dissatisfied with their employer’s learning and development (L&D) function and only 12% of employees applied new skills learned in L&D programs to do their jobs.

Searching for an answer, a trio of Cambridge scientists — Chibeza Agley, Sarra Achouri and Juergen Fink — co-founded Obrizum, a company that applies “adaptive learning” techniques to upskill and reskill staff. Leveraging an AI engine, the co-founders claim that Obrizum can tailor corporate learning experiences to individual staffers, identifying knowledge gaps and measuring things like learning efficiency.

“It’s becoming increasingly apparent that businesses will need to continue to invest heavily in efficient, successful training and knowledge sharing regardless of their workplace setup,” Agley, Obrizum’s CEO, told TechCrunch in an interview. “We are solving the widespread industry issue of efficiency. Businesses have less time available than ever before to create programs of learning or assessment. Meanwhile, there is more and more information to be taught.”

Image Credits: Obrizum

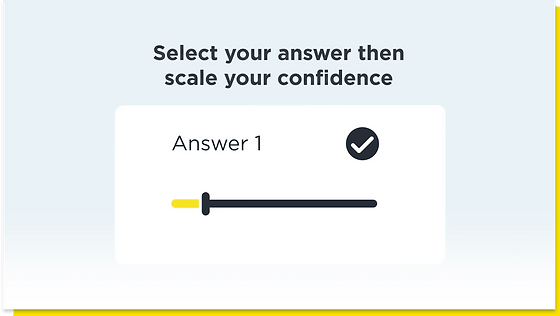

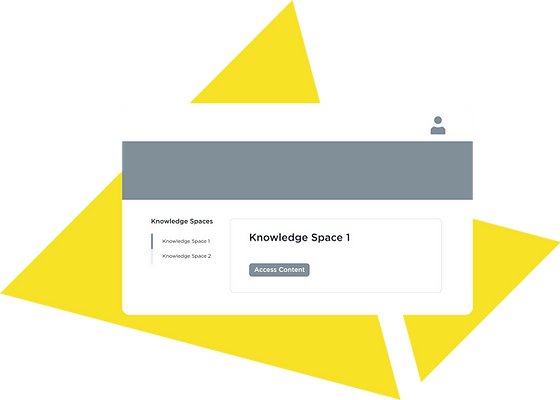

So how does Obrizum purport to achieve this? By creating what Agley calls “knowledge spaces” rather than linear training courses. Obrizum works with a company’s existing training resources, analyzing and curating webcasts, PDFs, slide decks, infographics and even virtual reality content into white-label modules that adjust based on a learner’s performance on regular assessments.

Obrizum’s algorithms can both reinforce concepts and emphasize weaker areas, Agley claims, by detecting guessing and “click-through cheating” (i.e., fast-forwarding through videos).

“Obrizum makes it much easier to surface and make use of valuable information that might not traditionally be used to learning or training,” Agley said. “In Obrizum, the individual’s data is used to benefit the individual — which is how it should be. Then, at an organizational level, machine learning can be used to spot trends and patterns which can benefit the majority. . . . Managers can see real-time summary data including usage statistics and a breakdown of performance relative to core concepts for groups of learners. Management level users can also drill down into the performance and activity of individual users.”

For employees uncomfortable with Obrizum’s analytics in an era of pervasive workplace surveillance, fortunately they can anonymize themselves and — in compliance with the GDPR — request the deletion of their personal data via self-service tools, Agley says.

As Obrizum looks toward the future, the company will invest in more comprehensive content automation and analytics technologies, integrations with third-party services and capabilities for collaboration and sharing, according to Agley. The pressure is on to stand out from rival platforms like Learnsoft, which lets set training happen automatically and track metrics like accreditation, as well as generate proof of credentials and certifications for management reviews and audits.

Obrizum also competes with Workera, a precision upskilling platform; software-as-a-service tool GrowthSpace; and to a lesser extent Go1, which provides a collection of online learning materials and tools to businesses that tap content from multiple publishers and silos. The good news is, corporate learning software remains a lucrative space, with investors pouring more than $2.1 billion into an assortment of startups focused on “skilling” employees between February 2021 and February 2021, according to Crunchbase data.

Image Credits: Obrizum

Agley claims that Obrizum is working with about 20 enterprise clients at present, including a growing cohort of government, aerospace and defense organizations. He demurred when asked about Obrizum’s revenue, revealing only that it has increased 17x since year-end 2020 — mostly due to client digital transformation efforts kicked off during the pandemic.

“Obrizum is a sector-agnostic solution which is key to our ability to scale quickly and resiliently even in the challenging macroeconomic climate. . . . Even when it comes to learning experience platforms, Obrizum stands out on its own by way of the level of automation, the granularity of its adaptability and the diagnostic detail of the analytics it offers,” Agley said. “We are incredibly optimistic about the opportunities in our sector despite the broader economic outlook. Learning has, and always will be, required in the world of work and in a post-pandemic world the corporate learning market is expanding fast.”

To date, Obrizum — which employs a staff of 38 — has raised $17 million in venture capital. That includes a $11.5 million Series A led by Guinness Ventures with participation from Beaubridge, Juno Capital Partners and Qatar Science & Tech Holdings and Celeres Ventures, which closed today.

-

Entertainment6 days ago

Entertainment6 days agoWhat’s new to streaming this week? (Jan. 17, 2025)

-

Entertainment6 days ago

Entertainment6 days agoExplainer: Age-verification bills for porn and social media

-

Entertainment5 days ago

Entertainment5 days agoIf TikTok is banned in the U.S., this is what it will look like for everyone else

-

Entertainment5 days ago

Entertainment5 days ago‘Night Call’ review: A bad day on the job makes for a superb action movie

-

Entertainment5 days ago

Entertainment5 days agoHow ‘Grand Theft Hamlet’ evolved from lockdown escape to Shakespearean success

-

Entertainment5 days ago

Entertainment5 days ago‘September 5’ review: a blinkered, noncommittal thriller about an Olympic hostage crisis

-

Entertainment5 days ago

Entertainment5 days ago‘Back in Action’ review: Cameron Diaz and Jamie Foxx team up for Gen X action-comedy

-

Entertainment5 days ago

Entertainment5 days ago‘One of Them Days’ review: Keke Palmer and SZA are friendship goals