Social Media

Facebook taps banks, but for chatbots not purchase data like Google

Backlash swelled this morning after Facebook’s aspirations in financial services were blown out of proportion by a Wall Street Journal report that neglected how the social network already works with banks. Facebook spokesperson Elisabeth Diana tells TechCrunch it’s not asking for credit card transaction data from banks and it’s not interested in building a dedicated banking feature where you could interact with your accounts. It also says its work with banks isn’t to gather data to power ad targeting, or even personalize content such as what Marketplace products you see based on what you buy elsewhere.

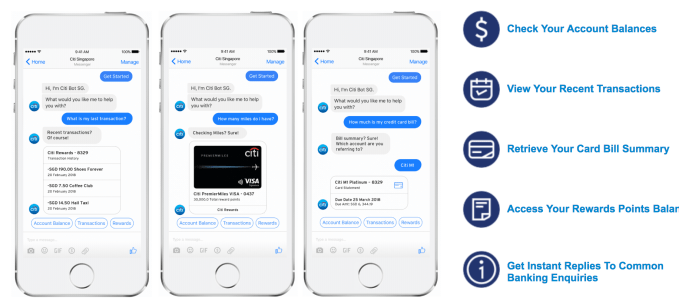

Instead, Facebook already lets Citibank customers in Singapore connect their accounts so they can ping their bank’s Messenger chatbot to check their balance, report fraud, or get customer service’s help if they’re locked out of their account without having to wait on hold on the phone. That chatbot integration, which has no humans on the other end to limit privacy risks, was announced last year and launched this March. Facebook works with PayPal in over 40 countries to let users get receipts via Messenger for their purchases.

Expansions of these partnerships to more financial services providers could boost usage of Messenger by increasing its convenience — and make it more of a centralized utility akin to China’s WeChat. But Facebook’s relationships with banks in the current form aren’t likely to produce a step change in ad targeting power that warrants significant heightening of its earning expectations. The reality of today’s news is out of step with the 3.5 percent share price climb triggered by the WSJ’s report.

“A recent Wall Street Journal story implies incorrectly that we are actively asking financial services companies for financial transaction data – this is not true. Like many online companies with commerce businesses, we partner with banks and credit card companies to offer services like customer chat or account management. Account linking enables people to receive real-time updates in Facebook Messenger where people can keep track of their transaction data like account balances, receipts, and shipping updates” Diana told TechCrunch. “The idea is that messaging with a bank can be better than waiting on hold over the phone – and it’s completely opt-in. We’re not using this information beyond enabling these types of experiences – not for advertising or anything else. A critical part of these partnerships is keeping people’s information safe and secure.”

Diana says banks and credit card companies have also approached it about potential partnerships, not just the other way around as the WSJ reports. She says any features that come from those talks with be opt-in, rather than happening behind users’ backs. The spokesperson stressed these integrations would only be built if they could be privacy safe. For example, signing up to use the Citibank Messenger chatbot requires two-factor authentication through your phone.

But renewed interest in Facebook’s dealings with banks comes at a time when many are pointing to its poor track record with privacy following the Cambridge Analytica scandal where people were duped into volunteering the personal info of them and their friends. Facebook hasn’t had a big traditional data breach where data was outright stolen, as has befallen LinkedIn, eBay, Yahoo [part of TechCrunch’s parent company], and others. But users are rightfully reluctant to see Facebook ingest any more of their sensitive data for fear it could leak or be misused.

Facebook has recently cracked down on the use of data brokers that suck in public and purchased data sets for ad targeting. It no longer lets data brokers upload Managed Custom Audience lists of user contact info or power Partner Categories for targeting ads based on interests. It also more admantly demands that advertisers have the consent of users whose email addresses or phone numbers they upload for Custom Audience targeting, though Facebook does little to verify that consent and advertisers could still buy data sets from brokers and upload them themselves.

Facebook has recently cracked down on the use of data brokers that suck in public and purchased data sets for ad targeting. It no longer lets data brokers upload Managed Custom Audience lists of user contact info or power Partner Categories for targeting ads based on interests. It also more admantly demands that advertisers have the consent of users whose email addresses or phone numbers they upload for Custom Audience targeting, though Facebook does little to verify that consent and advertisers could still buy data sets from brokers and upload them themselves.

Facebook’s statement today shows more scruples than Google, which last year struck an ad targeting data deals with data brokers that have access to 70 percent of credit and debit card transactions in the U.S. That led to a formal complaint to the FTC from the Electronic Privacy Information Center.

Cambridge Analytica has brought on an overdue era of scrutiny regarding privacy and how internet giants use our data. Practices that were overlooked, accepted as industry standard, or seen as just the way business gets done are coming under fire. Interent users aren’t likely to escape ads, and some would rather have those they see be relevant thanks to deep targeting data. But the combination of our offline purchase behavior with our online identities seems to trigger uproar absent from sites using cookies to track our web browsing and buying.

Facebook’s probably better off backing away from anything that involves sensitive data like checking account balances until Cambridge Analytica blows over and its proven its newfound sense of responsibility translates into a safer social networking. But at least for now, it’s not slurping up our banking data wholesale.

-

Entertainment7 days ago

Entertainment7 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment7 days ago

Entertainment7 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment6 days ago

Entertainment6 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment5 days ago

Entertainment5 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment4 days ago

Entertainment4 days agoHow to watch ‘Smile 2’ at home: When is it streaming?

-

Entertainment3 days ago

Entertainment3 days ago‘Wicked’ review: Ariana Grande and Cynthia Erivo aspire to movie musical magic

-

Entertainment2 days ago

Entertainment2 days agoA24 is selling chocolate now. But what would their films actually taste like?

-

Entertainment3 days ago

Entertainment3 days agoNew teen video-viewing guidelines: What you should know