Social Media

Nextdoor beats expectations in first earnings report since going public last year

Today after the bell, locally focused social network Nextdoor reported its fourth-quarter earnings. The company combined with a SPAC last November, making today its first quarterly report since going public.

In good news for both Nextdoor investors and the general SPAC market, the company managed to best revenue expectations, leading to modest share-price appreciation in after-hours trading this afternoon. While still sharply under its pre-combination price of $10 per share — Nextdoor’s stock is worth $6.50 after its small after-hours gains — the company’s results are generally positive and worth our time to unpack.

Nextdoor’s Q4

In the fourth quarter of 2021, Nextdoor recorded revenues of $59.3 million, up 47.9% from its year-ago tally of $40.1 million. However, the company also had an expensive quarter, with operating costs of $88.6 million — up sharply from a year-ago mark of $55.5 million — leading to a larger net loss of $29.3 million in the quarter, up from $14.9 million in Q4 2020.

What drove the huge gain in costs that led to Nextdoor’s profitability taking a hit? Partially a sizable uptick in share-based compensation costs, something that we often see in companies that recently went public. For that reason, adjusted EBITDA may be a more reasonable profit metric for Nextdoor for this particular quarter. By that metric, Nextdoor lost a far-smaller $7.8 million, up only marginally from a year-ago adjusted EBITDA deficit of $7.6 million.

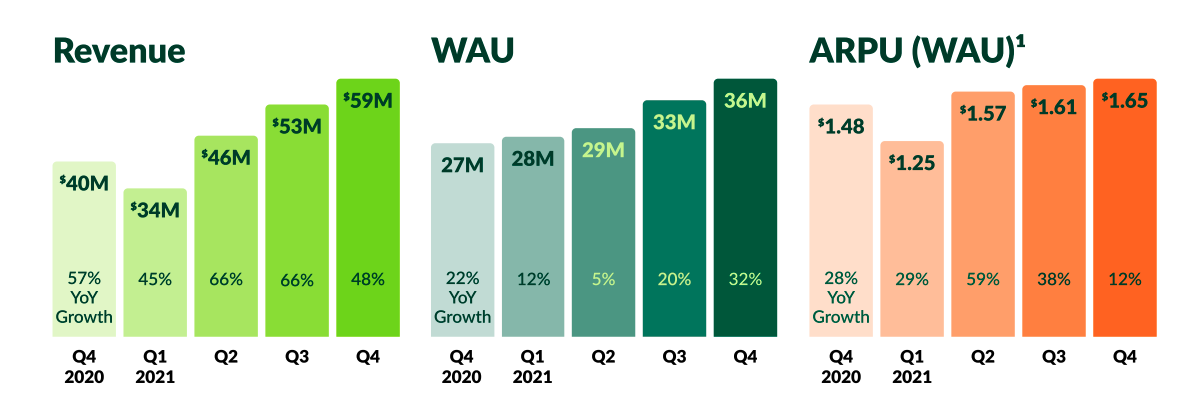

Social networks tend to provide a set of user-focused metrics to go along with their raw financial data, giving investors a look inside the mechanics of their community. Nextdoor is no different. I present to you a set of colorful bar charts:

Image Credits: Nextdoor investor presentation

Revenue we have discussed, so let’s focus on the other two datasets. WAU, or weekly active users, is a key metric for Nextdoor; if its user count falls, it likely won’t be able to close a revenue gap by merely squeezing more top-line from remaining users. Recall that Meta is having this issue to some degree. In good news for Nextdoor, WAU growth looks pretty solid in its last few quarters.

Even more, the company set what is at least a local maximum in its ARPU per WAU. What does that mean? The metric tracks average revenue per user for weekly active users. I guess we could call this ARPWAU? Which, incidentally, is the same sound that one might make if someone threw a bowling ball into their stomach.

Regardless, more WAU and more ARPU per WAU means more revenue. Which is what Nextdoor wants.

The future

Investors had expected Nextdoor to report $55.4 million in revenue in Q4 2021, per Yahoo Finance data. The company beat that mark.

Looking ahead, investors anticipate revenue of $48.41 million in Q2 2022 and $260.0 million for the year. In its earnings report, Nextdoor said that it expects $48 million worth of revenue for the current quarter and “between” $254 million and $256 million in revenue for the year, up from a prior target of $252 million.

Why aren’t shares of Nextdoor appreciating more in light of its revenue beat and generally OK-looking user activity results? Perhaps the slight gap between its full-year 2022 guidance and street expectations. Investors like strong trailing results, but they also covet forecasts that best expectations, and Nextdoor didn’t manage to both in its latest report.

-

Entertainment6 days ago

Entertainment6 days ago‘Interior Chinatown’ review: A very ambitious, very meta police procedural spoof

-

Entertainment5 days ago

Entertainment5 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment6 days ago

Entertainment6 days agoX users are fleeing to BlueSky: Here’s a quick-start guide on how to sign up

-

Entertainment7 days ago

Entertainment7 days ago6 gadgets to help keep your home clean, from robot vacuums to electric scrubbers

-

Entertainment5 days ago

Entertainment5 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment4 days ago

Entertainment4 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment4 days ago

Entertainment4 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment3 days ago

Entertainment3 days agoHow to watch ‘Smile 2’ at home: When is it streaming?