Business

Insify is modernizing insurance, but this time for SMEs

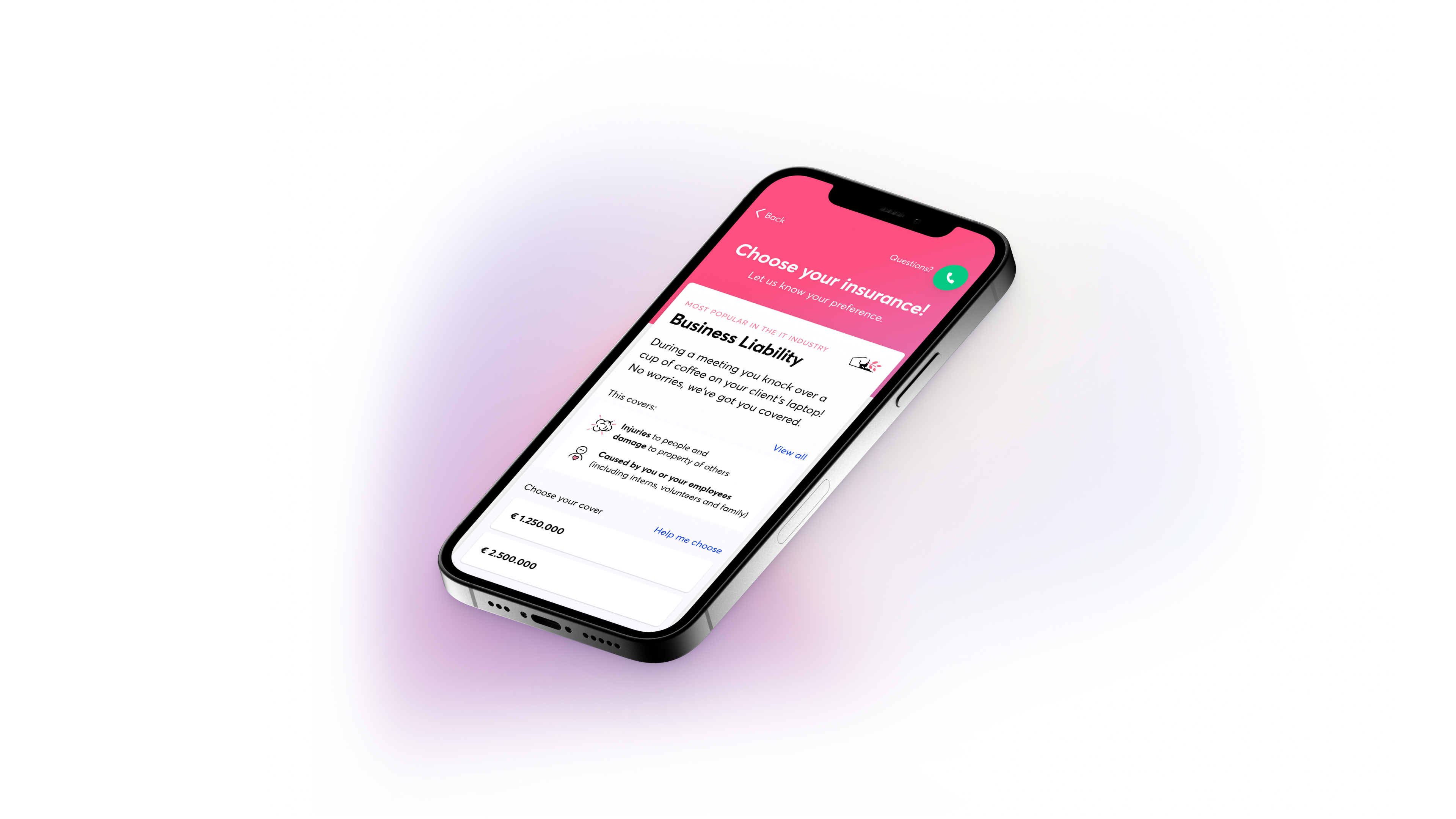

Meet Insify, an insurtech startup that raised a $17 million (€15 million) Series A round led by Accel. The company wants to modernize the insurance market. Instead of focusing on the consumer market like many insurtech startups, Insify has picked a different path. It’s a pure B2B play as Insify focuses on Europe’s small and medium companies.

Originally started in the Netherlands, Insify founder and CEO Koen Thijssen previously worked on Bloomon, a flower e-commerce startup. After selling this company to Bloom & Wild, he wanted to fix a pain point that he encountered while building Bloomon — business insurance hasn’t changed much and can slow you down.

With Insify, companies that are just getting started can get a property and casualty insurance without much effort. The company currently mostly relies on direct subscriptions on its website. More recently, it has started embedding its insurance products in other products, such as Bol.com.

Insify tries to price its insurance contracts thanks to several data sources so that you don’t have to fill out complicated forms. Its insurance products are backed by Munich Re. So far, 1,500 companies have become Insify clients.

The startup focuses on small companies because it’s an underserved markets. Freelancers or teams of 2, 5 or 10 people don’t have a ton of options. Insurers mostly serve this market through brokers. And those brokers sometimes aren’t very responsive.

“Legacy insurers and brokers find it more complex to service small businesses than consumers, yet premiums are much lower than with medium-size or large businesses. Hence, the segment of freelancers and small businesses has long been neglected,” Koen Thijssen said.

If you want to get started as a freelancer and you already have found your first client, chances are you’ll need to share your insurance contract before you can close the deal. With Insify, you don’t have to wait several days to receive your insurance document.

“Overall, we see a very large opportunity in Embedded Insurance, especially in the segment of small businesses, and have made this one of our strategic priorities,” Koen Thijssen said.

So it sounds like Insify has found a way to address an underserved market with a good distribution strategy. In the future, Insify plans to expand to other products, such as life insurance, and other markets around Europe.

Image Credits: Insify

-

Entertainment6 days ago

Entertainment6 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment7 days ago

Entertainment7 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment5 days ago

Entertainment5 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment5 days ago

Entertainment5 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment4 days ago

Entertainment4 days agoHow to watch ‘Smile 2’ at home: When is it streaming?

-

Entertainment3 days ago

Entertainment3 days ago‘Wicked’ review: Ariana Grande and Cynthia Erivo aspire to movie musical magic

-

Entertainment2 days ago

Entertainment2 days agoA24 is selling chocolate now. But what would their films actually taste like?

-

Entertainment3 days ago

Entertainment3 days agoNew teen video-viewing guidelines: What you should know