Business

Inside Secfi’s 2021 state of stock options equity report

Last year set a new record for public exits, with more than 844 U.S. companies going public via an initial public offering (IPO), a direct listing, or through a special purpose acquisition company (SPAC). That’s 105% higher than 2020, which saw 410 similar companies go public, according to PitchBook.

The 20 largest U.S. IPOs generated an estimated $41 billion in pre-tax value for employees who held stock options in those companies.

Record public exit activity is good news for founders and investors, but what about the employees who were granted stock options in those companies?

We dove into our proprietary data as well as publicly available data filed with the U.S. Securities and Exchange Commission to uncover defining trends for employees from late-stage unicorns in 2021.

Here’s an overview of what we found:

Employees could have paid less in taxes by exercising their stock options before their company went public.

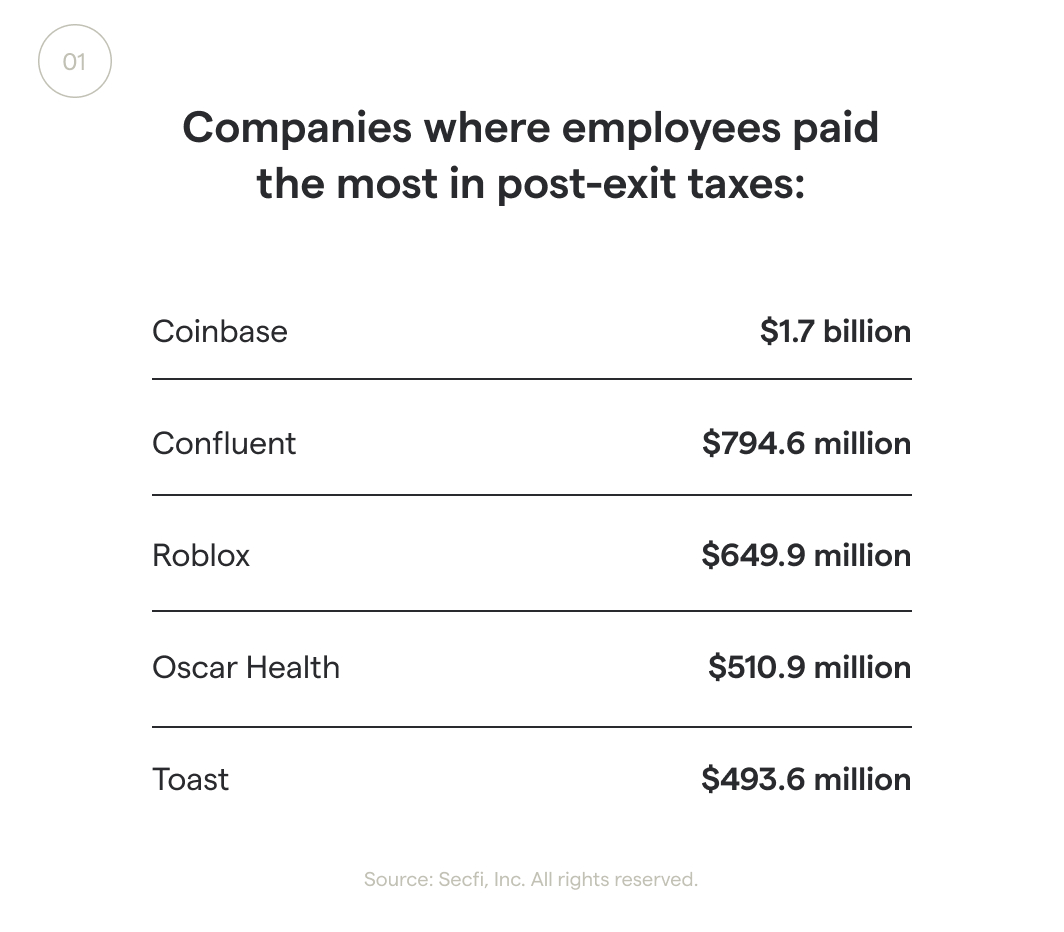

- In 2021, startup employees paid an estimated $11 billion in avoidable taxes by exercising their stock options post-exit, rather than pre-exit.

- On average, Secfi clients paid $543,254 in 2021 to exercise their pre-exit stock options (roughly double their annual household income), with taxes accounting for 73% of the cost.

- Employees at companies that went public in 2021 saved nearly $415,000, on average, by exercising before an IPO.

- Pre-exit stock option exercise rates vary widely from company to company, from as little as 2.4% on the low end to more than 77% on the high end, which could represent an indication of employee confidence in their company.

$11 billion in unnecessary taxes paid in 2021

In 2021, employees working at VC-backed U.S. startups that went public paid an estimated $11 billion in extra taxes because they waited to exercise their stock options post-exit, per a Secfi estimate of 172 U.S.-based, VC-backed public exits.

Employees could have paid less in taxes by exercising their stock options before their company went public. Doing so could have also maximized their gains when selling their shares. In 2021, high stock option exercise costs remained a major barrier to people exercising their stock options early.

Employees paid $11 billion in unnecessary taxes in 2021. Image Credits: Secfi

The cost to exercise stock options in 2021

-

Entertainment6 days ago

Entertainment6 days agoHow to watch Pharrell’s ‘Piece by Piece’ at home: When is it streaming?

-

Entertainment6 days ago

Entertainment6 days ago‘Gladiator II’ review: Ridley Scott grapples with modern masculinity in ancient Rome

-

Entertainment5 days ago

Entertainment5 days agoBookTok’s growing rift over politics is heating up

-

Entertainment4 days ago

Entertainment4 days agoTrump taps Musk for ‘Department of Government Efficiency’: What it is and what’s at risk.

-

Entertainment5 days ago

Entertainment5 days agoTrump appoints Elon Musk to DOGE, a new U.S. government department

-

Entertainment4 days ago

Entertainment4 days agoGreatest birthday gifts for men: Practical and posh presents that are sure to please

-

Entertainment4 days ago

Entertainment4 days agoStocking up on holiday gift cards? Watch out for this scam.

-

Entertainment2 days ago

Entertainment2 days ago‘Interior Chinatown’ review: A very ambitious, very meta police procedural spoof