Business

How to be one of the ‘haves’ of SaaS

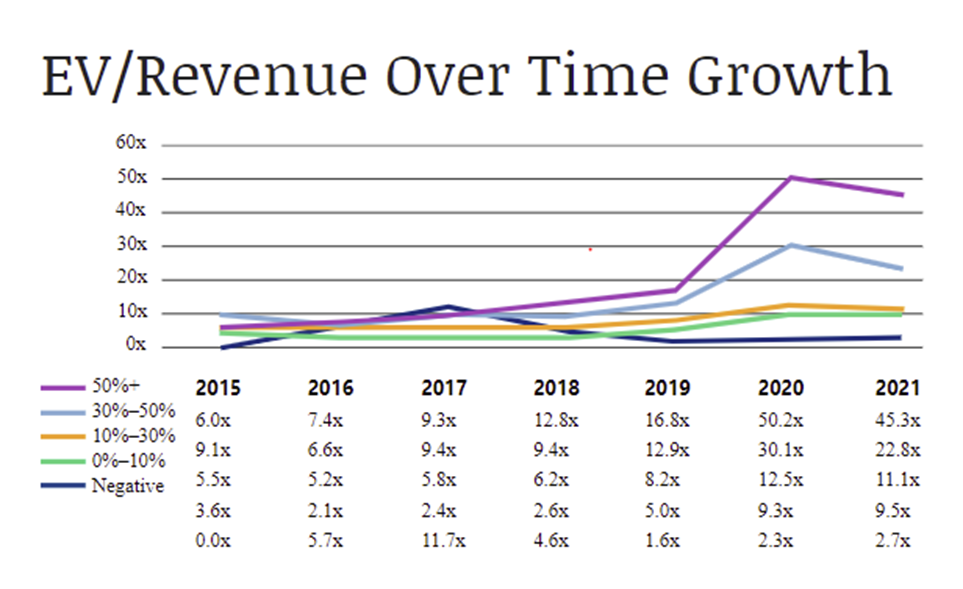

The flow of capital in SaaS is becoming increasingly bifurcated. There are the “haves” (public companies with revenue growth of over 30%) and the “have nots” (everyone else) of B2B software.

The chart below demonstrates just how drastically the “haves” separated themselves from the rest. With average EV/revenue multiple up +28.5x for companies that grew over 50% and +9.9x for companies that grew 30%-50% since 2019, compared to just +2.9x for those that grew by 10%-30%.

The real trick is identifying why certain companies are “haves” and how they remain that way. Put differently, what is it about companies like Zoom, Datadog, Monday.com and Asana that drive their outsized valuations? More importantly, are there strategies or tactics that management teams can employ to optimize for this type of outcome?

Growth in EV/revenue over time. Image Credits: OpenView Partners

Recent research shows that there are three key steps to becoming a “have”:

- Continued execution against large and growing market opportunities.

-

Entertainment7 days ago

Entertainment7 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment7 days ago

Entertainment7 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment6 days ago

Entertainment6 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment5 days ago

Entertainment5 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment4 days ago

Entertainment4 days agoHow to watch ‘Smile 2’ at home: When is it streaming?

-

Entertainment3 days ago

Entertainment3 days ago‘Wicked’ review: Ariana Grande and Cynthia Erivo aspire to movie musical magic

-

Entertainment2 days ago

Entertainment2 days agoA24 is selling chocolate now. But what would their films actually taste like?

-

Entertainment3 days ago

Entertainment3 days agoNew teen video-viewing guidelines: What you should know