Social Media

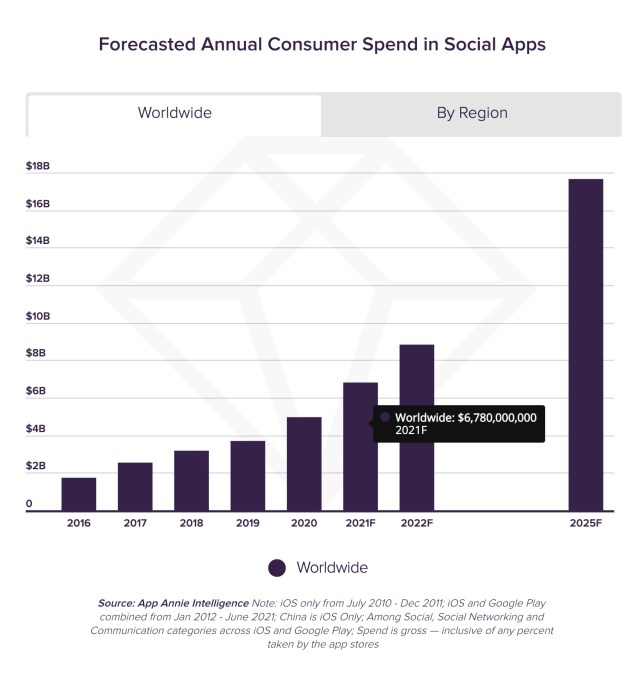

Driven by live streams, consumer spending in social apps to hit $17.2B in 2025

The live streaming boom is driving a significant uptick in the creator economy, as a new forecast estimates consumers will spend $6.78 billion in social apps in 2021. That figure will grow to $17.2 billion annually by 2025, according to data from mobile data firm App Annie, which notes the upward trend represents a five-year compound annual growth rate (CAGR) of 29%. By that point, the lifetime total spend in social apps will reach $78 billion, the firm reports.

Image Credits: App Annie

Initially, much of the livestream economy was based on one-off purchases like sticker packs, but today, consumers are gifting content creators directly during their live streams. Some of these donations can be incredibly high, at times. Twitch streamer ExoticChaotic was gifted $75,000 during a live session on Fortnite, which was one of the largest ever donations on the game streaming social network. Meanwhile, App Annie notes another platform, Bigo Live, is enabling broadcasters to earn up to $24,000 per month through their live streams.

Apps that offer live streaming as a prominent feature are also those that are driving the majority of today’s social app spending, the report says. In the first half of this year, $3 out every $4 spend in the top 25 social apps came from apps that offered live streams, for example.

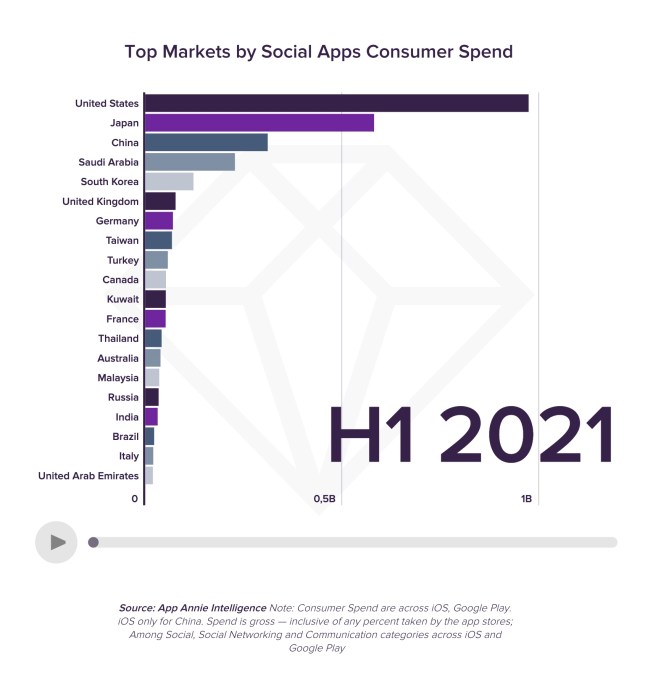

Image Credits: App Annie

During the first half of 2021, the U.S. become the top market for consumer spending inside social apps with 1.7x the spend of the next largest market, Japan, and representing 30% of the market by spend. China, Saudi Arabia, and South Korea followed to round out the top 5.

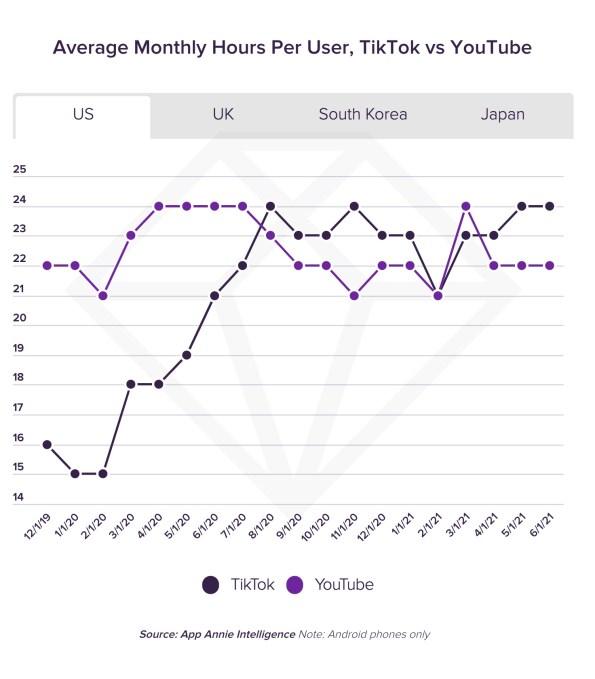

Image Credits: App Annie

While both creators and the platforms are financially benefitting from the live streaming economy, the platforms are benefitting in other ways beyond their commissions on in-app purchases. Live streams are helping to drive demand for these social apps and they help to boost other key engagement metrics, like time spent in app.

One top app that’s significantly gaining here is TikTok.

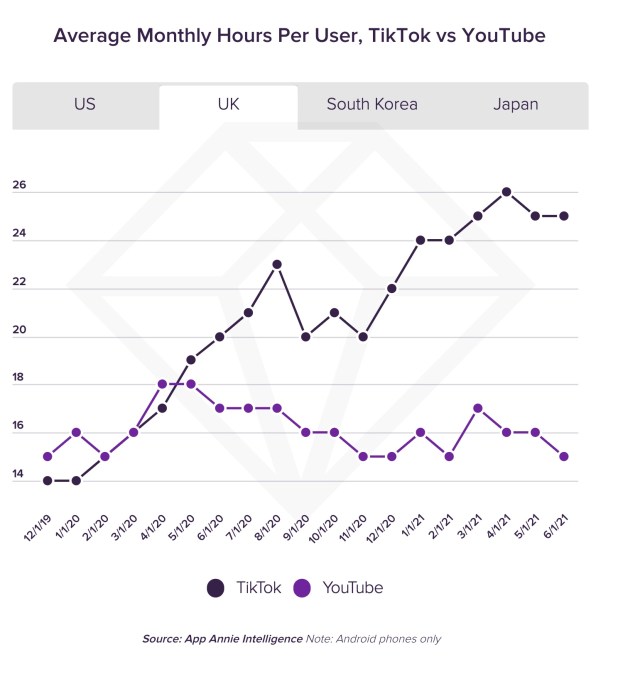

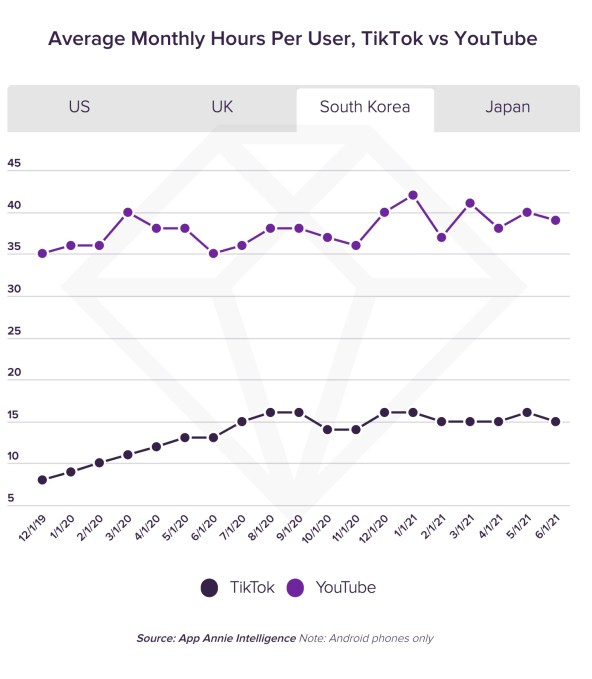

Last year, TikTok surpassed YouTube in the U.S. and the U.K. in terms of the average monthly time spent per user. It often continues to lead in the former market, and more decisively leads in the latter.

Image Credits: App Annie

Image Credits: App Annie

In other markets, like South Korea and Japan, TikTok is making strides, but YouTube still leads by a wide margin. (In South Korea, YouTube leads by 2.5x, in fact.)

Image Credits: App Annie

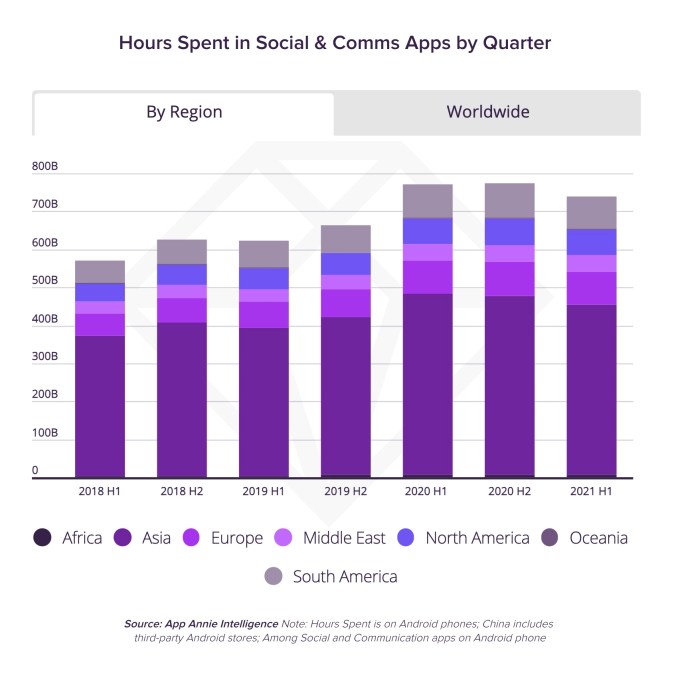

Beyond just TikTok, consumers spent 740 billion hours in social apps in the first half of the year, which is equal to 44% of the time spent on mobile globally. Time spent in these apps has continued to trend upwards over the years, with growth that’s up 30% in the first half of 2021 compared to the same period in 2018.

Today, the apps that enable live streaming are outpacing those that focus on chat, photo or video. This is why companies like Instagram are now announcing dramatic shifts in focus, like how they’re “no longer a photo sharing app.” They know they need to more fully shift to video or they will be left behind.

The total time spent in the top five social apps that have an emphasis on live streaming are now set to surpass half a trillion hours on Android phones alone this year, not including China. That’s a three-year CAGR of 25% versus just 15% for apps in the Chat and Photo & Video categories, App Annie noted.

Image Credits: App Annie

Thanks to growth in India, the Asia-Pacific region now accounts for 60% of the time spent in social apps. As India’s growth in this area increased over the past 3.5 years, it shrunk the gap between itself and China from 115% in 2018 to just 7% in the first half of this year.

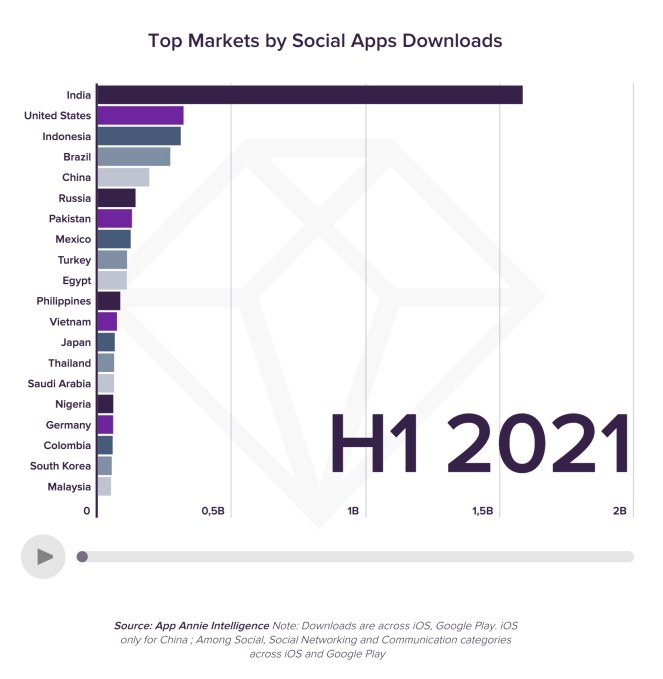

Social app downloads are also continuing to grow, due to the growth in live streaming.

To date, consumers have downloaded social apps 74 billion times and that demand remains strong, with 4.7 billion downloads in the first half of 2021 alone — up 50% year-over-year. In the first half of the year, Asia was the largest region region for social app downloads, accounting for 60% of the market.

This is largely due to India, the top market by a factor of 5x, which surpassed the U.S. back in 2018. India is followed by the U.S., Indonesia, Brazil and China, in terms of downloads.

Image Credits: App Annie

The shift towards live streaming and video has also impacted what sort of apps consumers are interested in downloading, not just the number of downloads.

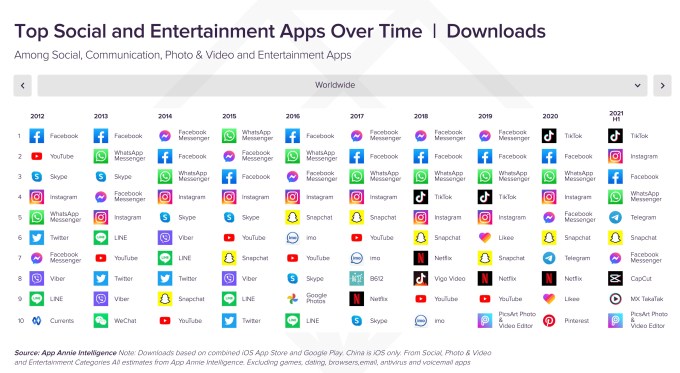

A chart that show the top global apps from 2012 to the present highlights Facebook’s slipping grip. While its apps (Facebook, Messenger, Instagram and Facebook) have dominated the top spots over the years in various positions, TikTok popped into the number one position last year, and continues to maintain that ranking in 2021.

Further down the chart, other apps that aid in video editing have also overtaken others that had been more focused on photos or chat.

Image Credits: App Annie

Video apps like YouTube (#1), TikTok (#2) Tencent Video (#4), Bigo Live (#5), Twitch (#6), and others also now rank at the top of the global charts by consumer spending in the first half of 2021.

But YouTube (#1) still dominates in time spent compared with TikTok (#5), and others from Facebook — the company holds the next three spots for Facebook, WhatsApp and Instagram, respectively.

This could explain why TikTok is now exploring the idea of allowing users to upload even longer videos, by increasing the limit from 3 minutes to 5, for instance.

In addition, because of live streaming’s ability to drive growth in terms of time spent, it’s also likely the reason why TikTok has been heavily investing in new features for its TikTok LIVE platform, including things like events, support for co-hosts, Q&As and more, and why it made the “LIVE” button a more prominent feature in its app and user experience.

App Annie’s report also digs into the impact live streaming has had on specific platforms, like Twitch and Bigo Live, the former which doubled its monthly active user base from the pre-pandemic era, and the latter which saw $314.2 million in consumer spend during H1 2021.

“The ability of social media users to communicate with each other using live video – or watch others’ live broadcasts – has not only maintained the growth of a social media app market, but contributed to its exponential growth in engagement metrics like time spent, that might otherwise have saturated some time ago,” wrote App Annie’s Head of Insights, Lexi Sydow, when announcing the new report.

The full report is available here.

-

Entertainment7 days ago

Entertainment7 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment7 days ago

Entertainment7 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment6 days ago

Entertainment6 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment5 days ago

Entertainment5 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment4 days ago

Entertainment4 days agoHow to watch ‘Smile 2’ at home: When is it streaming?

-

Entertainment4 days ago

Entertainment4 days ago‘Wicked’ review: Ariana Grande and Cynthia Erivo aspire to movie musical magic

-

Entertainment3 days ago

Entertainment3 days agoA24 is selling chocolate now. But what would their films actually taste like?

-

Entertainment3 days ago

Entertainment3 days agoNew teen video-viewing guidelines: What you should know