Business

Despite flat growth, ride-hailing colossus Didi’s US IPO could reach $70B

Didi filed to go public in the United States last night, providing a look into the Chinese ride-hailing company’s business. This morning, we’re extending our earlier reporting on the company to dive into its numerical performance, economic health and possible valuation.

Recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive.

Didi is approaching the American public markets at a fortuitous moment. While the late-2020 IPO fervor, which sent offerings from DoorDash and others skyrocketing after their debuts, has cooled, valuations for public companies remain high compared to historical norms. And Uber and Lyft, two American ride-hailing companies, have been posting numbers that point to at least a modest recovery in the ride-hailing industry as COVID-19 abates in many parts of the world.

As further grounding, recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive. As we explore the company’s finances, then, we’re more than vetting a single company’s performance; we’re examining what sort of returns an ocean of capital may be able to derive from its exit.

In that vein, we’ll consider GMV results, revenue growth, historical profitability, present-day profitability and what Didi may be worth on the American markets, given current comps. Sound good? Into the breach!

Inside Didi’s IPO filing

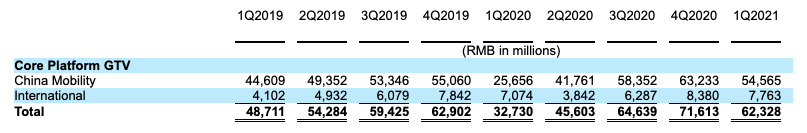

Starting at the highest level, how quickly has gross transaction volume (GTV) scaled at the company?

GTV

Didi is historically a business that operates in China but has operations today in more than a dozen countries. The impact and recovery of China’s bout with COVID-19 is therefore not the whole picture of the company’s GTV results.

COVID-19 began to affect the company starting in the first quarter of 2020. From the Didi F-1 filing:

Core Platform GTV fell by 32.8% in the first quarter of 2020 as compared to the first quarter of 2019, and then by 16.0% in the second quarter of 2020 as compared to the second quarter of 2019.

The dips were short-lived, however, with Didi quickly returning to growth in the second half of the year:

Our businesses resumed growth in the second half of 2020, which moderated the impact on a year-on-year basis. Our Core Platform GTV for the full year 2020 decreased by 4.8% as compared to the full year 2019. Both our China Mobility and International segments were impacted, but whereas the GTV for our China Mobility segment decreased by 6.6% from 2019 to 2020, the GTV for our International segment increased by 11.4% from 2019 to 2020.

Holding to just the Chinese market, we can see how rapidly Didi managed to pick itself up over the last year. Chinese GTV at Didi grew from 25.7 billion RMB to 54.6 billion RMB from the first quarter of 2020 to the first quarter of 2021; naturally, we’re comparing a more pandemic-impacted quarter at the company to a less-affected period, but the comparison is still useful for showing how the company recovered from early-2020 lows.

The number of transactions that Didi recorded in China during the first quarter of this year was also up more than 2x year over year.

On a whole-company basis, Didi’s “core platform GTV,” or the “sum of GTV for our China Mobility and International segments,” posted numbers that are less impressive in growth terms:

Image Credits: Didi F-1 filing

You can see how quickly and painfully COVID-19 blunted Didi’s global operations. But seeing the company settle back to late-2019 GTV numbers in 2021 is not super bullish.

Takeaway: While Didi managed an impressive GTV recovery in China, its aggregate numbers are flatter, and recent quarterly trends are not incredibly attractive.

Revenue growth

-

Entertainment7 days ago

Entertainment7 days agoEarth’s mini moon could be a chunk of the big moon, scientists say

-

Entertainment7 days ago

Entertainment7 days agoThe space station is leaking. Why it hasn’t imperiled the mission.

-

Entertainment6 days ago

Entertainment6 days ago‘Dune: Prophecy’ review: The Bene Gesserit shine in this sci-fi showstopper

-

Entertainment5 days ago

Entertainment5 days agoBlack Friday 2024: The greatest early deals in Australia – live now

-

Entertainment4 days ago

Entertainment4 days agoHow to watch ‘Smile 2’ at home: When is it streaming?

-

Entertainment3 days ago

Entertainment3 days ago‘Wicked’ review: Ariana Grande and Cynthia Erivo aspire to movie musical magic

-

Entertainment2 days ago

Entertainment2 days agoA24 is selling chocolate now. But what would their films actually taste like?

-

Entertainment3 days ago

Entertainment3 days agoNew teen video-viewing guidelines: What you should know