Business

BREAKING: Budget 2021 Rishi Sunak Announces SEISS Extension

Today at the 3rd March Budget presented by Rishi Sunak, the follow have been announced:

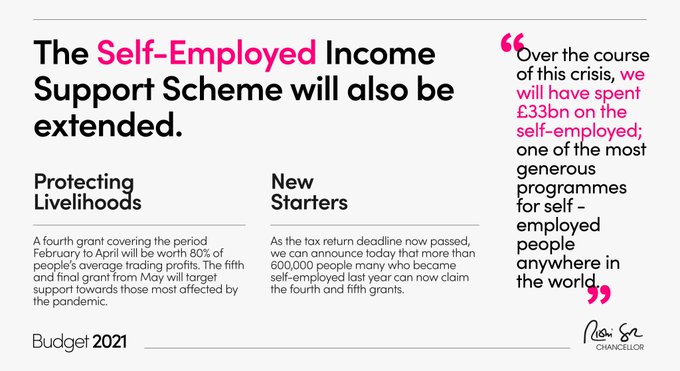

Support for the self-employed will continue with a 4th grant covering February to April, and a 5th grant from May. As the tax return deadline has now passed, 600,000 more people, many of whom became self-employed last year, can now claim the 4th and 5th grants.

We’re taking what works to get people into jobs and making it better. Today we’re doubling the apprentice incentive payments we give businesses to £3,000 – that’s for all new hires, of any age.

We’re providing new Restart Grants to help businesses reopen.

Together with Oliver Dowden we’re extending the Culture Recovery Fund and supporting our arts, culture and sporting institutions as they reopen. We’re introducing a new approach to apprenticeships in the creative industries, and extending the TV restart scheme.

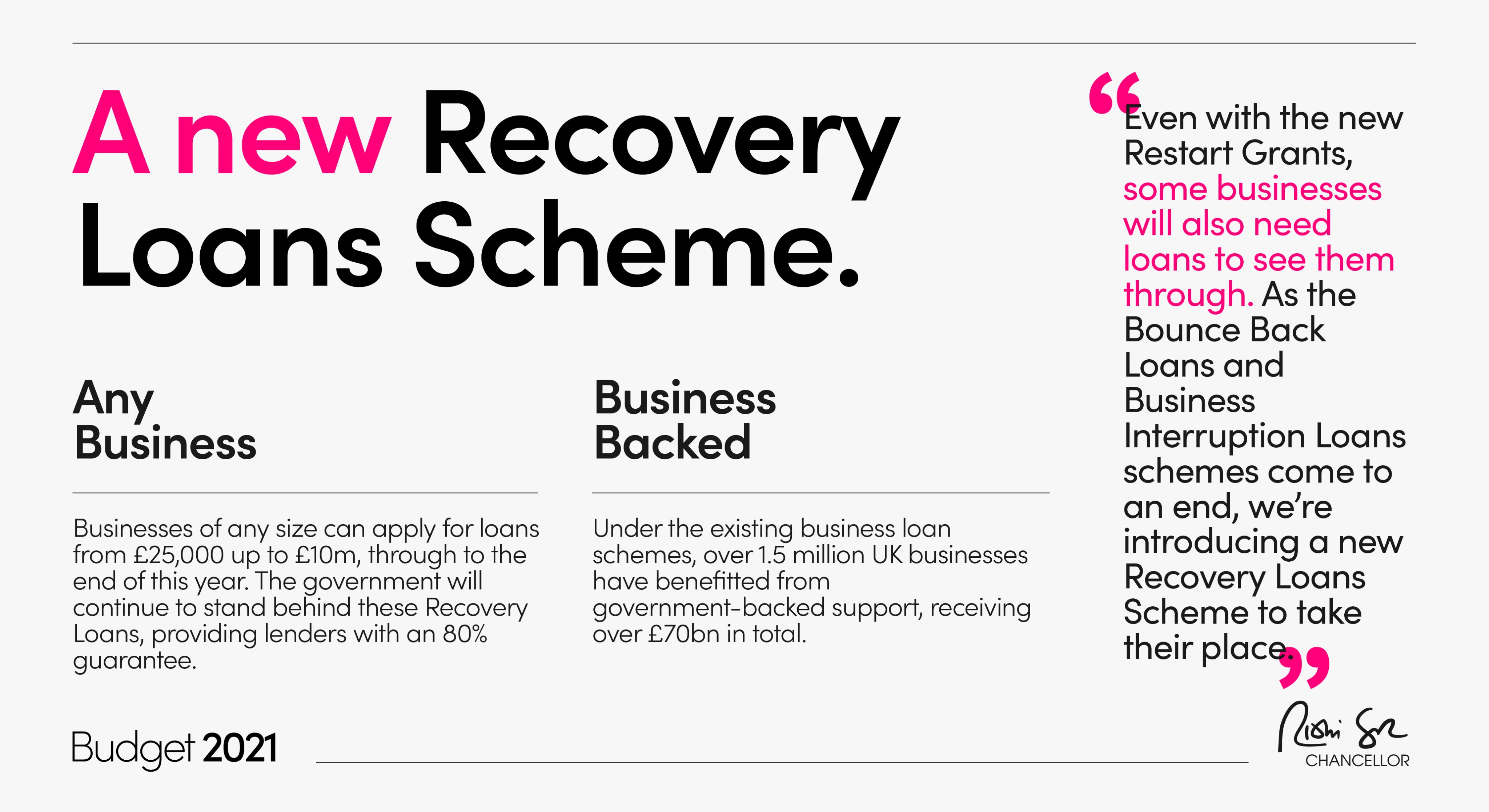

As the Bounce Back Loan and CBIL schemes come to an end, we’re introducing a new Recovery Loan Scheme to take their place.

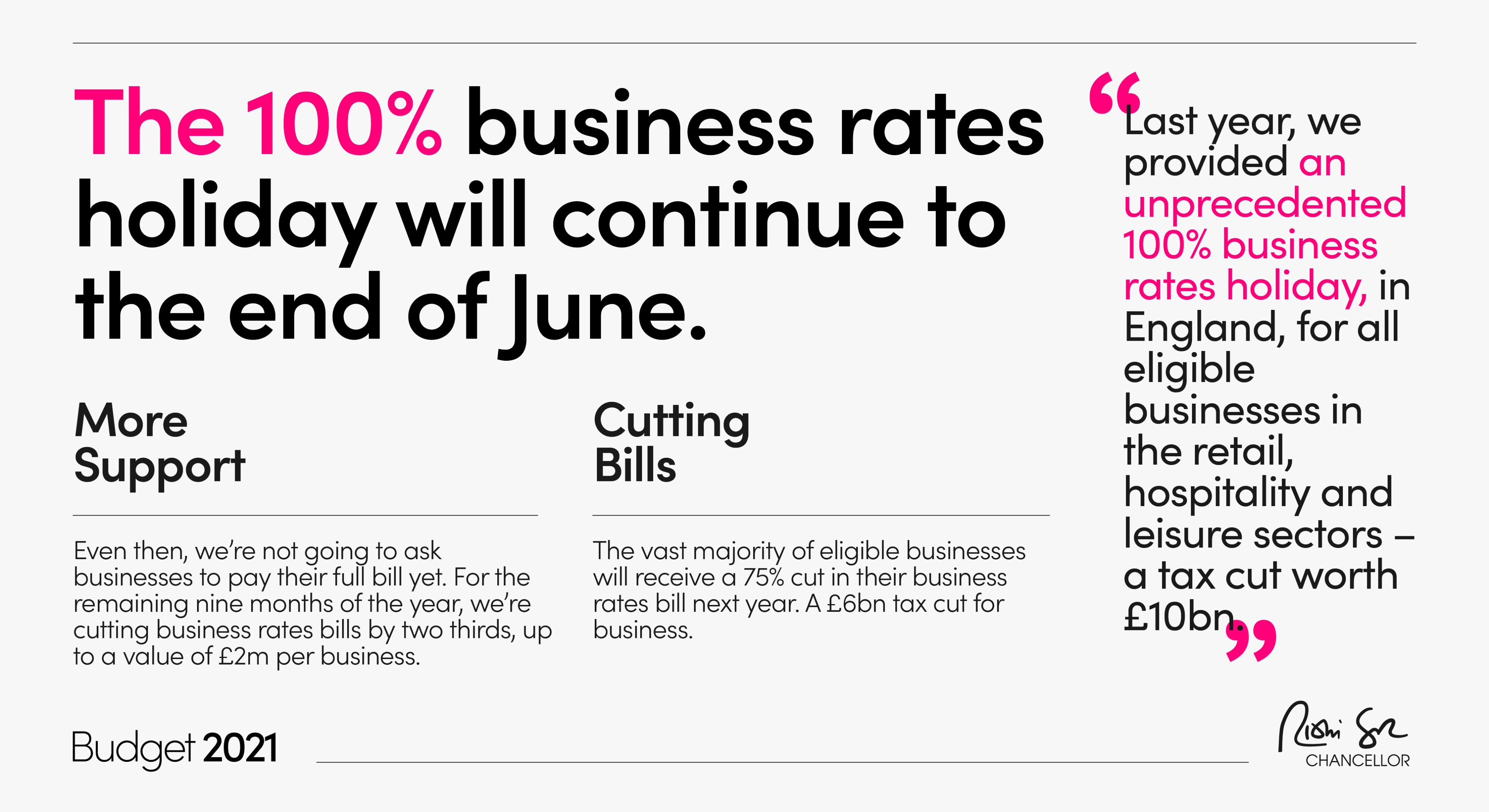

We’ll continue with the 100% business rates holiday through to the end of June. For the remaining nine months of the year, business rates will still be discounted by two thirds, up to a value of £2m for closed businesses. A £6bn tax cut for business.

To protect hospitality and tourism jobs, the 5% reduced rate of VAT will be extended for six months to 30th September. And even then, we won’t go straight back to the 20% rate. We’ll have an interim rate of 12.5% for another six months.

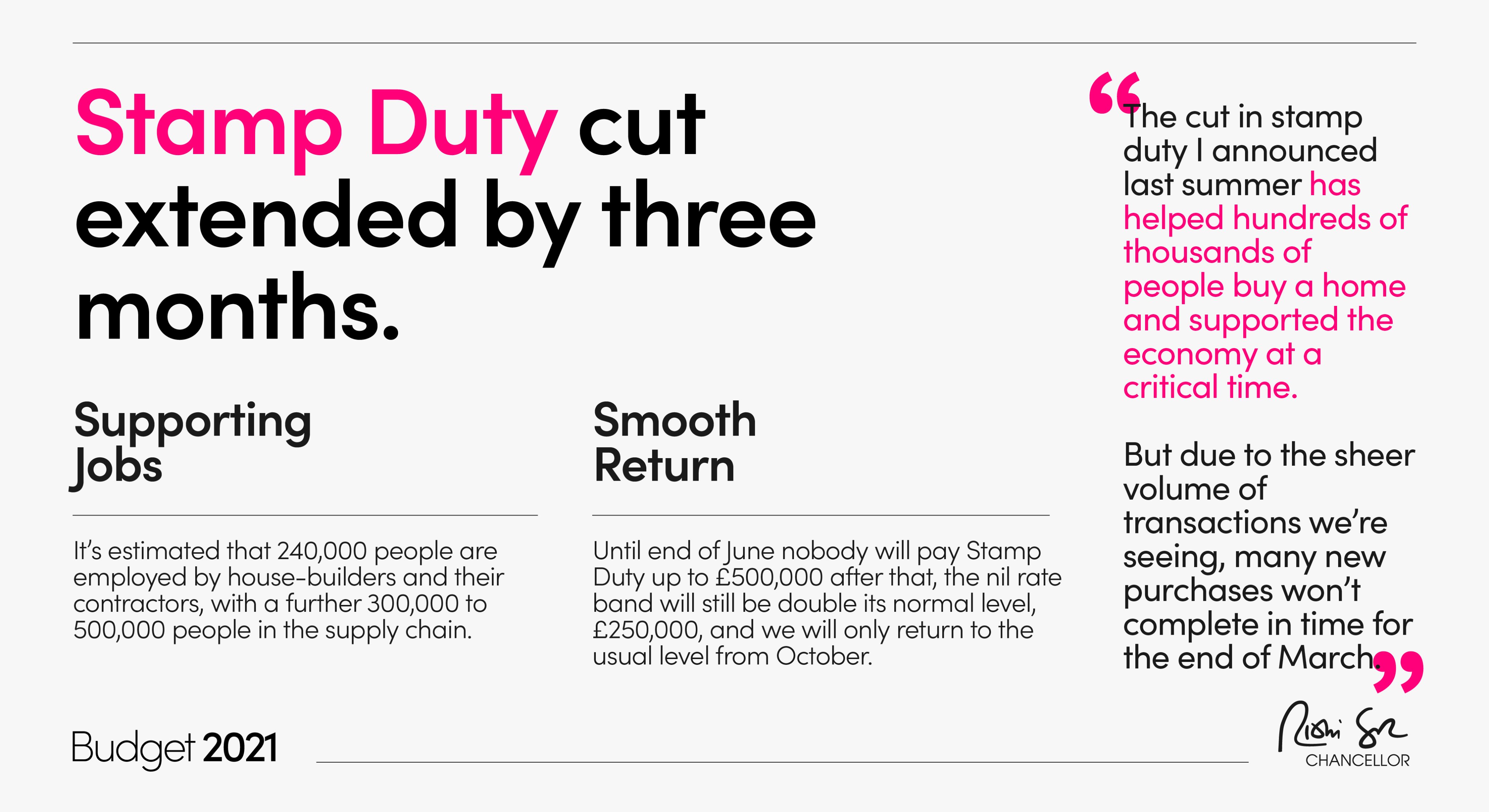

The new £500,000 nil rate band for Stamp Duty won’t end on 31st March, it will end on the 30th June. Then, to smooth the transition back to normal, the nil rate band will be £250,000, double its standard level, until the end of September.

A new policy to stand behind homebuyers: a mortgage guarantee. Lenders who provide mortgages to home buyers who can only afford a 5% deposit, will benefit from a government guarantee on those mortgages.

We’re not going to raise the rates of income tax, national insurance, or VAT. Instead, we are freezing personal tax thresholds. Nobody’s take home pay will be less than it is now, as a result of this. It is a tax policy that is progressive and fair.

We’ll also tackle fraud in our COVID schemes, with £100m to set up a new Taxpayer Protection Taskforce of around 1,000 investigators.

In 2023 the rate of corporation tax, paid on company profits, will increase to 25%. Even after this change we’ll still have the lowest corporation tax rate in the G7. We’ll also protect small businesses so only 10% of companies will pay the full higher rate.

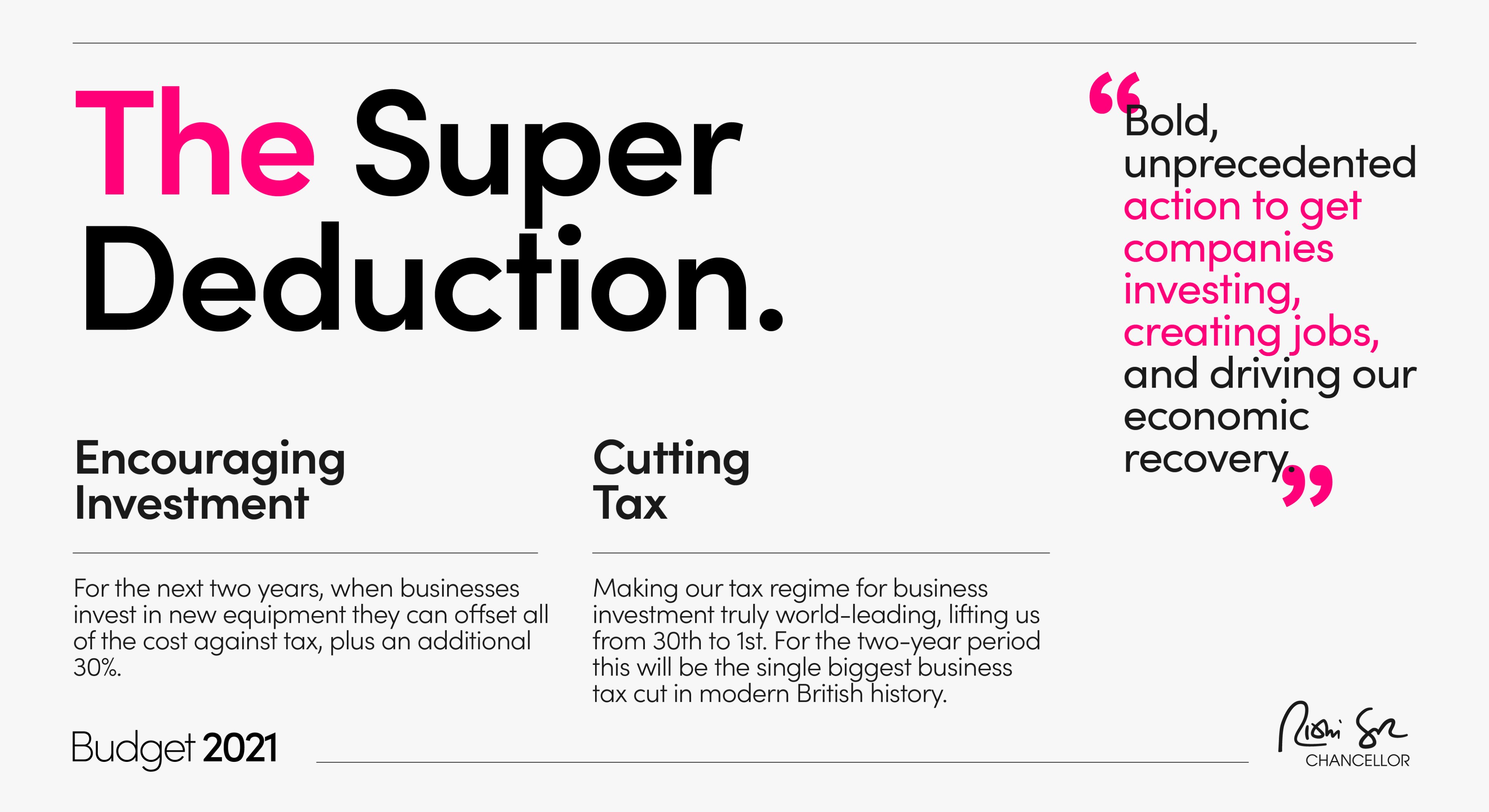

The Super Deduction makes our tax regime for business investment truly world-leading, lifting us from 30th in the OECD, to 1st. For the next two years, we’re allowing businesses to claim 130% of their new machinery cost as a tax cut.

The planned increases in duties for spirits like Scotch whisky, wine, cider and beer, will all be cancelled.

Budget reactions from those is the property industry

5% mortgage deposit scheme

5% mortgage deposit scheme

Marc von Grundherr, Director of lettings and estate agent Benham and Reeves, commented’:

“While Help to Buy in its various forms has helped homebuyers to an extent, it’s also done a good job of pushing house prices higher and homeownership even further out of reach for many.

To roll this sort of counterproductive initiative out to the whole of the market wouldn’t be so bad if the government also addressed the issue of supply. If you have trouble climbing the stairs you need to add a handrail, not increase the size of the staircase. However, the government has, yet again, chosen to do just this.”

CEO of Enness Global Mortgages, Islay Robinson commented:

“95% mortgage products in any shape or form take the market into pretty overheated, dangerous territory and we’ve previously seen the results of this kind of precarious lending to those who aren’t really in the financial position to commit to it.

As always, the devil will be in the detail but many lenders have already tightened their belts over the last few months in terms of their high loan to value offerings.

Although many big lenders have committed to the government’s announcement today, it will be interesting to see just how many buyers are able to secure such a product when it comes to actually applying.

Converting Generation Rent to Generation Buy is a noble initiative but not if it comes at the expense of wider market health.”

Stamp Duty Holiday Extension

CEO of Keller Williams UK, Ben Taylor, commented:

“Today’s stamp duty holiday extension will be very warmly welcomed by homebuyers waiting to complete and currently stuck in the transaction pipeline due to market delays.

The original stamp duty holiday is on track to save homebuyers an estimated £1.5bn and with the extension in place, this benefit should increase to £2bn with 360,000 transactions likely to benefit until the new June deadline.

However, the rabbit out of the hat of this Budget is the welcome news that the minimum threshold will increase to £250,000 until the end of September, bringing a further saving and a softer landing as the market returns to normality. This equates to a further saving of £2,500 for those completing once the main deadline has expired.

But with the holiday bringing such huge benefit to the market, surely it’s time for the government to re-evaluate the tax charged on home purchases on a permanent basis?”

Matthew Cooper, Founder & Managing Director of Yes Homebuyers, commented:

“Ironic, perhaps, that a delayed Budget should deliver a delayed stamp duty holiday deadline, which does little more than delaying the inevitable reality that awaits the market when the reprieve does finally end.

Those brave enough to tackle the huge market delays already being seen should do so now as there are very dark clouds building in June. While a staggered return to normality is likely to reduce the impact of the current cliff edge, it’s still likely to bring a shower of transaction falls through and house price decline down on the market.”

Founder and CEO of GetAgent.co.uk, Colby Short, commented:

“The Budget is fast becoming the government’s equivalent to Groundhog Day, full of headline-grabbing announcements to benefit homebuyers and fuel demand, with little to no intent on addressing the issue of supply.

It’s as if each time the Budget roles around, the Chancellor looks at the consistent failings of his predecessors and says to the Prime Minister, ‘hold my briefcase’, as he looks to go one better. Or worse, as the case may be.”

What was missing?

James Forrester, Managing Director of lettings and estate agent Barrows and Forrester, commented:

“Extremely disappointing to see the Government maintain their head in the sand stance on building more homes.

They usually talk a good game with regard to house building and we often hear dramatic cries of ‘build, build, build’ when the Budget rolls around. Unfortunately, the only thing that has been built is the suspense waiting for them to deliver on these promises.

This time around we didn’t even see the usual empty rhetoric and hot air, so we can assume that they will continue to ignore what is perhaps the biggest problem currently impacting the housing market.”

Co-Founder of UniHomes, Phil Greaves, commented:

“Great news to see that for once, the government has decided to ease the pressure placed on the throats of hard pressed landlords in recent years, with no increase in capital gains tax announcement and no further tax relief reductions.

Deterring landlords will only ever reduce the level of rental stock available to satisfy the huge number of people reliant on the sector in order to live. Let’s hope the government has now realised that without landlords providing the infrastructure that underpins much of our social housing they will end up with a rental crisis of their own making.”

-

Entertainment6 days ago

Entertainment6 days agoWordPress.org’s login page demands you pledge loyalty to pineapple pizza

-

Entertainment7 days ago

Entertainment7 days agoThe 22 greatest horror films of 2024, and where to watch them

-

Entertainment6 days ago

Entertainment6 days agoRules for blocking or going no contact after a breakup

-

Entertainment5 days ago

Entertainment5 days ago‘Mufasa: The Lion King’ review: Can Barry Jenkins break the Disney machine?

-

Entertainment5 days ago

Entertainment5 days agoOpenAI’s plan to make ChatGPT the ‘everything app’ has never been more clear

-

Entertainment4 days ago

Entertainment4 days ago‘The Last Showgirl’ review: Pamela Anderson leads a shattering ensemble as an aging burlesque entertainer

-

Entertainment5 days ago

Entertainment5 days agoHow to watch NFL Christmas Gameday and Beyoncé halftime

-

Entertainment4 days ago

Entertainment4 days agoPolyamorous influencer breakups: What happens when hypervisible relationships end